Support CleanTechnica’s work through a Substack subscription or on Stripe.

Under a recent article I wrote about Tesla’s robot manifesto possibly being just an investment Hail Mary from Tesla, reader “Assaf” made the following comment:

“Well, judging by the stock ticker, the Wall Street scammers and their victims happily lapped this crap ‘Master Plan’ up.

“I would not expect any different from Wall Street and from people who believe in Wall Street.

“The Onion nailed it already in July 2008: ‘Recession-Plagued Nation Demands New Bubble To Invest In’“

It’s an interesting point, and a brilliant article from 2008! And this does get to a root question I’ve been wondering for quite a while.

The economy goes up and down, but, in general, there’s a class of people with a good amount of money to invest in the stock market, and they are truly not that hurt by economic ups and downs. They don’t struggle to pay the bills or buy food in hard economic times, and they don’t need to sell stocks to get by. More or less, people who have invested in the stock market for years and have a lot of extra cash for that purpose do not want to go take that money out of the stock market (especially if that would result in having to pay a lot more in taxes). One way or another, they are hoping their invested dollars will grow a lot over time, and they are just looking for the next opportunity to have them do that. So, even when things are going badly, they are inclined to leave their money in the market.

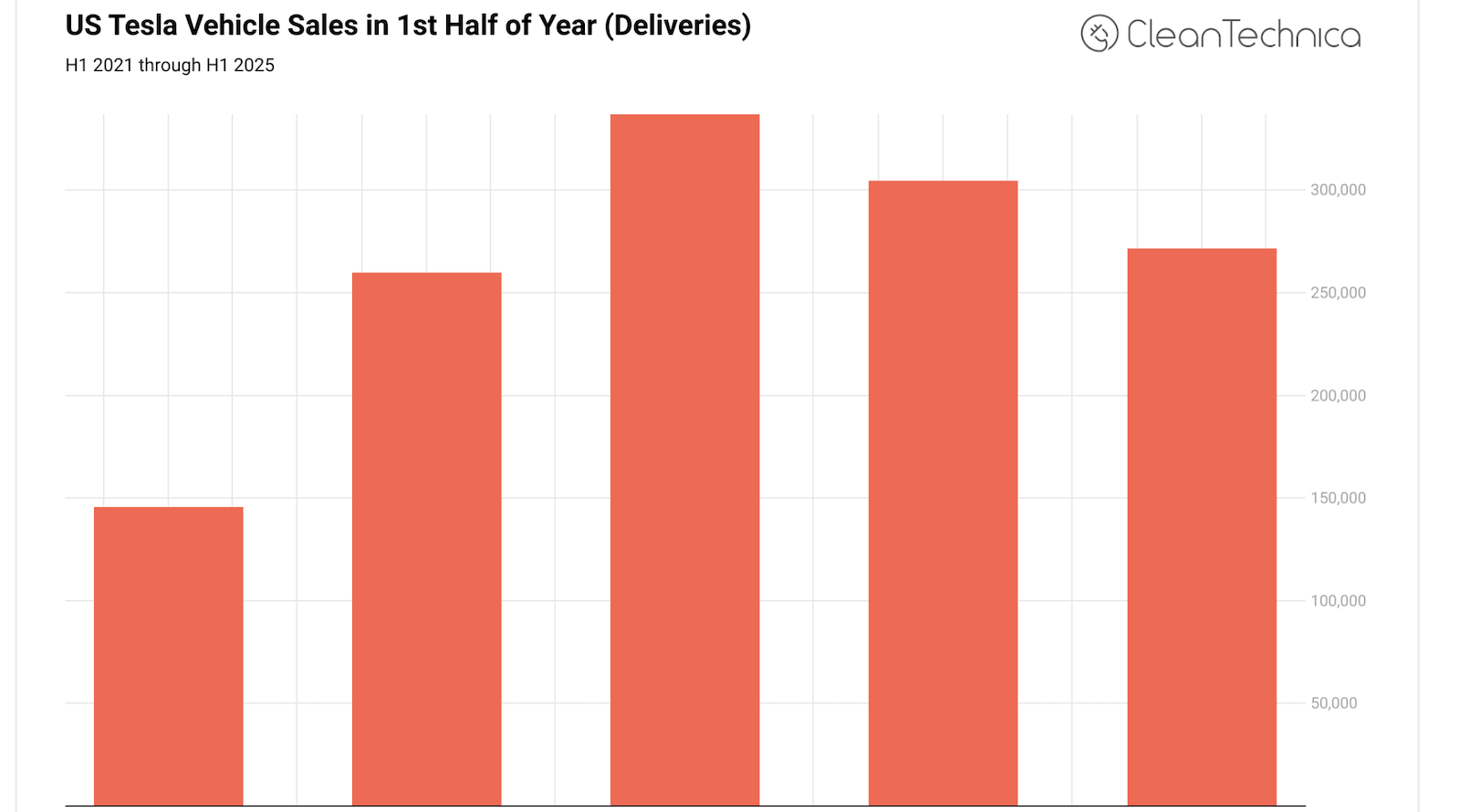

In the case of Tesla specifically, for a long time, it was identified as a key growth company that was disrupting a massive industry. Skeptics thought Tesla would die for years, but it survived and thrived. As the company got bigger and bigger, and then turned profitable, more and more “smart money” was going into Tesla. The company was expected to keep rapidly innovating and rapidly growing. One could still try to argue the former is taking place (it’s rapidly innovating), but the latter has very clearly not been the case for the past couple of years (Tesla has been declining, not growing). Tesla keeps losing sales year over year, but there’s no obvious replacement for it. What other company stands alone in the disruption of a massive industry? Even if Tesla’s story has died a bit, who’s got the next big Tesla story?

This article is not only about Tesla, though. Money is also getting poured into Bitcoin, NVIDIA, Oracle, and others. People who have a lot of money are not going to put all that money under their mattresses. They want to put it into stocks (or currencies) of the future. They are desperate to find a place where their money can see hypergrowth.

Tesla, for years, was the clear stock for hypergrowth, but it was also a concept that was easy to grasp — a new kind of car company that had almost the whole market to conquer. I think a lot of money is staying in the stock because there’s no obvious alternative, no other simple and compelling company story that is pulling people away from TSLA and into a new direction. Where is the “next TSLA?” There is no clear next TSLA. So why not just keep that money in TSLA and hope that Tesla finds a way to innovate disruptively again and blow up in a new market? Tesla has only really done this in one market — cars. It failed in the solar power market in this regard. It has failed so far in heavy-duty trucks. It’s doing alright in battery storage systems and grid services, but the scale of that is still questionable and unproven. It’s about 5 years late in hitting robotaxi targets. Yes, it has done amazing things in the car market, but otherwise, it’s basically just talked about doing amazing things. But … where else to put one’s money? Who else has a more compelling story and clear success around the corner? And if there isn’t any obvious choice, why not just stick with Tesla and see if it can live up to Elon Musk’s hype?

Will TSLA turn out to be a massive investment bubble? Will sh** finally hit the fan with a mixture of dropping sales and failed AI goals? Who knows, but if it does, we can come back to that Onion article: the nation demands a new bubble to invest in. Of course, it’s not the nation as a whole. It’s the investment nation. They need some giant trend, and preferably some obvious company, to invest in. Until Tesla crashes (more than it has been crashing) and misses more big targets (more than it has been missing big targets), it appears the company will retain a massive market cap — well beyond anything any other auto company has. The hype around AI and robots still has people hanging on. If a large portion of the investment nation does lose faith in Tesla, though, those investors really need another hot supertrend to put their money into.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy