Last Updated on: 11th July 2025, 10:15 am

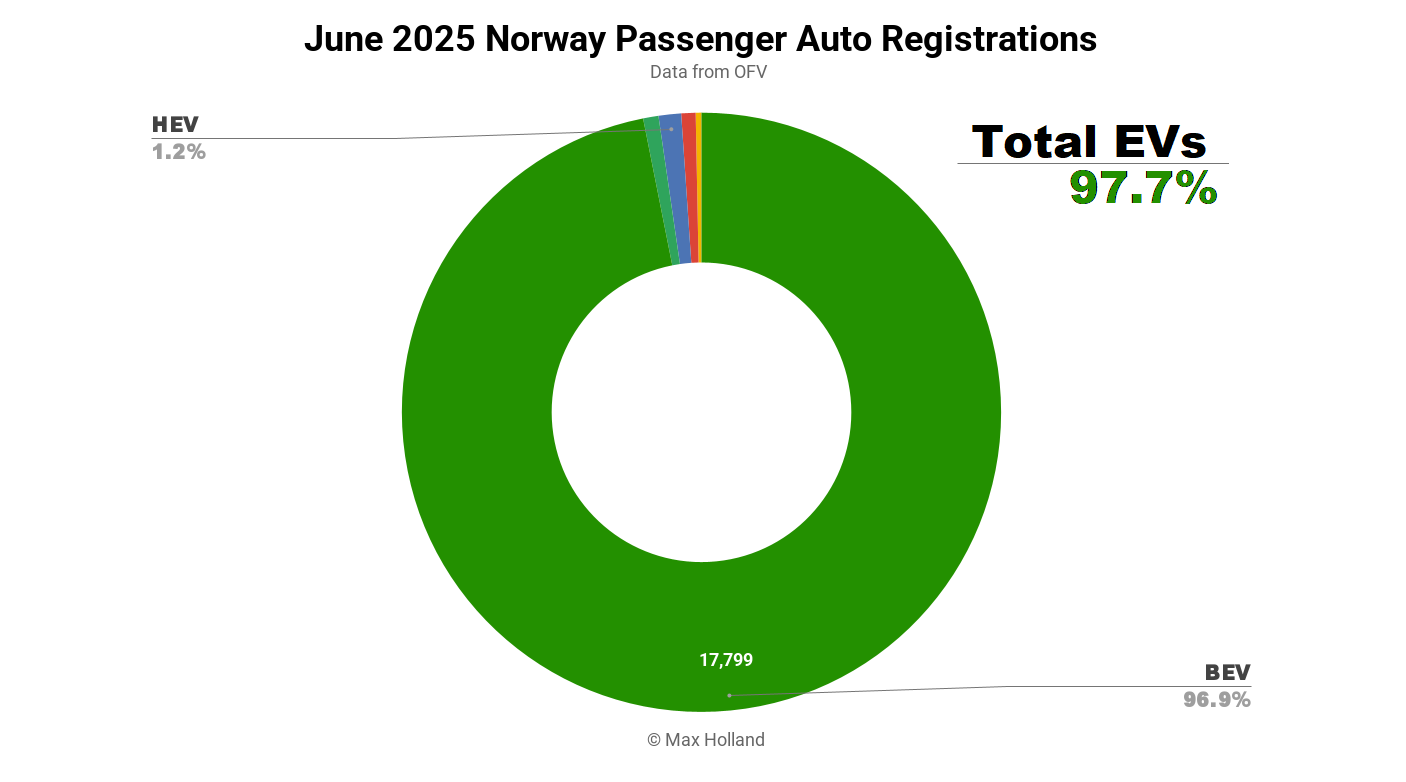

The June auto market saw plugin EVs take a record 97.7% share in Norway, up from 85.3% year-on-year. BEVs alone saw 96.9% of new sales. Total new passenger vehicle registrations for the month reached 18,373 units, up some 5% YoY and the biggest month in over 2 years. The Tesla Model Y was the best-selling vehicle with 5,000 units.

June’s sales saw combined EVs take a record 97.7% share in Norway, with 96.9% full battery electrics (BEVs) and 0.8% plugin hybrids (PHEVs). These compare with YoY figures of 85.3% combined, 80.0% BEV and 5.3% PHEV.

The June 2024 baseline was anomalous due to a changing tax policy disrupting the normal powertrain share. Stepping back, year-to-date 2025 is now at 96.1% combined plugin share, with 93.7% BEV, compared to 88.4% combined and 84.9% BEV at this point last year. This is strong continued progress considering that Norway is at the flat upper section of the adoption curve.

June’s record BEV share was helped by a huge delivery volume of the new Tesla Model Y, alone accounting for 28% of BEV sales. As the OFV notes, “One thing in particular sets Norway apart from the rest of Europe: Here at home, electric cars and Teslas are selling like hot cakes, while Tesla sales have fallen sharply in Europe.” (machine translation).

In terms of the residual sales of other powertrains, HEVs — which cannot run off renewable electricity — unfortunately they still sell more than PHEVs — which can. On the other hand, with the recent tax policy changes (from April 1st), at least diesels are no longer selling more than PHEVs; the two powertrains are roughly even. Petrol-only vehicles are now a faint trace, selling only around 50 units per month, and under 0.5% share.

Best-Selling Models

The Tesla Model Y was the best-selling auto in June, with 5,000 units delivered — more than the next 8 models combined. The 2nd and 3rd spots remained unchanged from May, with the Toyota bZ4X slightly ahead of the Volkswagen ID. Buzz.

Most of the top 20 are familiar models, with just some shuffling from minor monthly variations. Polestar, however, made record volumes on its Polestar 3 (almost four times its previous high) and Polestar 4 (around twice its previous high), pushing both into the top 20, from more typically residing in the 30th to 50th ranks. The BMW iX also jumped up to 6th from its recent ~30th ranking thanks to relatively high volumes (though nowhere near its peak volume of late 2022).

There was one new debutant in June, the Maxus eTerron 9, with 6 initial units. The eTerron 9 is a double-cab pickup truck with a length of 5,500 mm. Unlike Maxus’ existing and similarly sized T90 pickup, which was always limited to rear-wheel drive only, the eTerron has 4-wheel drive. It can thus function more reliably for farmers, foresters, and builders in varying gradients with mud and snow. The eTerron’s pricing, however, is much higher — starting from 750,000 NOK (63,400€) compared to 450,000 NOK (38,000€) for the older T90.

Maxus has likely seen the steady ~50 unit per month sales of Ford’s F-150 BEV, realised this niche is still underserved, and decided to get in on the action by substantially undercutting the Ford’s stratospheric 1,060,900 NOK (89,600€) price. Another key player in this niche in Europe, Isuzu, will also sell a BEV version of its legendary D-Max, in early 2026. There’s still room for more competition, though, and I’d like to see BYD offer its Shark pickup truck in Norway.

Regarding the market reception of recently launched BEV models, the Ford Puma (April debut) is treading water at 59 units in June, the MG S5 (March debut) is also steady, though at a higher 148 units. The Skoda Elroq (February debut) is steadily climbing, at 218 units. The Opel Frontera (May debut) climbed from its initial 36 units up to 62 in June.

The Zeekr 7x, which launched in April with a modest 4 units, increased to 41 units in May and 86 units in June. Let’s see what level it settles at.

The new generations of B-segment vehicles are still slowly finding their way in Norway. The Hyundai Inster led in June, with 98 units, and has averaged 66 units per month since its volume launch in February. The Renault 5 was close behind with 92 units, a decent improvement over its first big month in May (58 units). The Citroen e-C3 cooled to 80 units, a dip from its April–May average of 142 units.

The Renault 4 and Citroen e-C3 Aircross — both arguably better suited to Norway — have not yet launched. Nor has the BYD Dolphin Surf, with no fixed start date as yet, but surely coming, given BYD’s long presence in the Norwegian market.

Here’s the models ranking for the trailing 3 months:

With its huge June volumes, the Tesla Model Y has extended its lead, and saw more volume this past quarter than the next four models combined.

Most of the top 10 were fairly stable compared to Q1, but the BYD Sealion continues to steadily climb, thanks to a strong 533 units in June. It now sits in 8th spot, up from 27th in Q1. Likewise, the Volvo EX90 is still rising, now up to 18th from its prior 34th in Q1.

Just outside the top 20, the new Skoda Elroq has rapidly ascended to 21st, following its February debut — expect it to enter the chart next month. None of the small-and-affordable generation are yet close to the top 20, but on current trajectories, the Renault 5 has a chance to enter by the end of Q3. Let’s keep an eye on this.

Norway’s Fleet Transition

Fresh fleet data at the end of Q2 recorded a BEV share now up to 29.5% (up 0.75% over Q1), and PHEV share was steady at 7.2%. PHEV share has now peaked, and — with PHEVs now passé in Norway — will slowly subside in the coming years (as will HEV share, now at 5.4%).

Diesel-only share is still just about in the lead for now, with 32.9% (down around 0.6% per quarter on average), with petrol-only share at 25.0% (declining only around 0.3% per quarter). We should expect BEV share to start to take the lead over diesels by the end of Q4, or early Q1 2026. Interestingly, it is quite likely that — being on average older vehicles — diesels will start to decline faster over the coming few years, and may fall below the (newer) petrol-only fleet before the end of this decade.

For a full analysis of the dynamics of Norway’s fleet transition, and what it means for falling road-fuel consumption over time, take a look at my deep dive from a year or so ago.

Outlook

Norway’s consensus goal (not a legal absolute) was to aim for 100% BEV sales “by 2025,” and the market will get pretty close. Technology transition nerds know that there are, in fact, always a percent or two of tricky edge cases which take longer for new technologies to cater to. That’s not typically something to obsess about, especially when there are other low-hanging-fruit challenges which need attention (e.g., the adjacent cases of vans, trucks, buses, and later, shipping and aviation).

Opting for “98%” or “99%” doesn’t quite have the simple catchiness of “100%,” so it’s understandable that “100% BEVs” was the messaging. In the end, it’s all fine — the big picture is that the underlying aims will have been largely achieved by the end of this year, with monthly BEV share likely to be around 98% of the market, and still creeping forwards.

As the Norwegian OFV notes in its June commentary, macroeconomic conditions may be helping to boost car sales. Although latest YoY GDP figures (Q1 2025) showed a 0.4% contraction, the recent long-awaited interest rate lowering (to 4.25%) has given a signal which is helping with new car financing. Inflation was static at 3% in June. Manufacturing PMI dipped to 49.3 points, from 51.2 in May.

What are your thoughts on Norway’s EV transition? If monthly share is around 98% BEV at the end of this year, should we count that as a success in relation to the “100%” goal? What new models (and categories) will the market benefit from? Please share your perspective and thoughts in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy