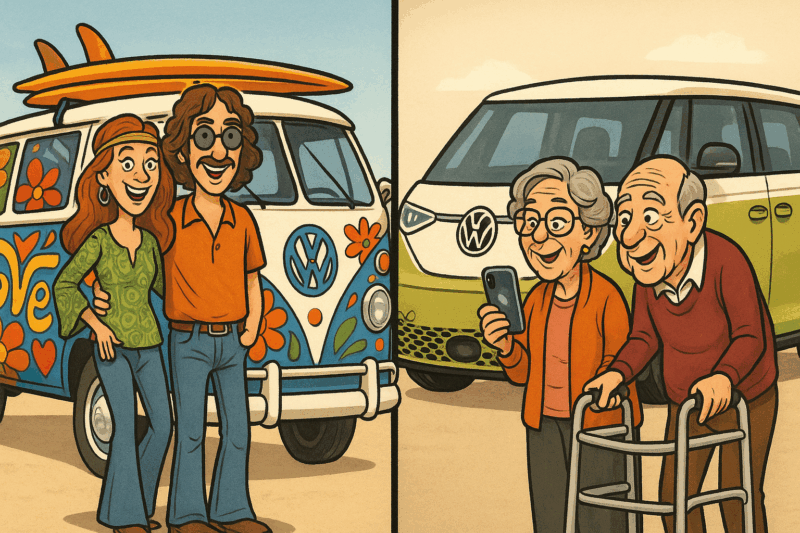

The Wall Street Journal recently described Volkswagen’s much-anticipated electric ID.Buzz as a commercial flop in the U.S. market. In isolation, such headlines contribute to US narratives that the electric vehicle transition itself is losing steam. My recent time in Europe, which included time in an ID.Buzz on the way to a gigawatt of wind, solar and batteries in a Dutch polder along with a lot of other VW electric microbuses on the roads, suggested that the US experience wasn’t universal.

A closer look reveals the complexity beneath these surface-level judgments. The reality is that the global EV market is thriving, yet distinctly regional in character. Understanding this regionality provides a nuanced perspective necessary to accurately interpret the ID.Buzz’s uneven performance.

The ID.Buzz’s American debut was indeed challenging. Volkswagen faced significant headwinds including high import tariffs, which reached around 27.5%, inflating the vehicle’s already steep pricing. Its limited EPA-estimated range of roughly 234 miles placed it at a disadvantage compared to rivals from Tesla, Hyundai, and Ford. The situation worsened further when Volkswagen was forced into a costly and embarrassing recall in April 2025 due to non-compliant brake-light warnings and overly wide third-row seats with only two provided seat belts. Shipments to the U.S. fell sharply, with fewer than 600 units reaching dealerships over a three-month period. These setbacks have severely compromised the original target of around 40,000 annual units.

While the ID.Buzz’s struggles in America are undeniable, this local narrative misses a larger, more instructive global story. In Europe, where the vehicle aligns well with both consumer preferences and robust EV infrastructure, the ID.Buzz has been remarkably successful. Through the first half of 2025, Volkswagen delivered around 27,600 units globally, the vast majority in Europe. This robust demand is part of a broader trend, with Volkswagen Group’s electric vehicle sales surging by approximately 90% year-on-year in the European market alone. There, the ID.Buzz is not just selling, but thriving.

Volkswagen’s experience is not unique. Honda’s electric city car, the Honda e, tells a parallel story. Widely celebrated for its innovative styling and compact size, it succeeded in gaining enthusiastic acceptance among European urban dwellers. However, Honda opted against releasing the model in the American market, concluding the short range of around 220 kilometers would be unappealing in the context of longer average commute distances and sprawling suburbs. The Honda e serves as a textbook example of how localized consumer behavior and geographic infrastructure can determine the viability of an EV.

Conversely, Ford’s Mustang Mach-E is a dominant player in the U.S. market, successfully leveraging its iconic branding and performance credentials to attract American consumers. In the first half of 2025, Ford delivered over 39,000 units domestically, an impressive result in a competitive landscape. Yet the Mustang Mach-E has struggled significantly in China. Despite Ford’s heavy investments, the Mach-E failed to capture meaningful market share against domestic competitors like BYD and NIO, both offering superior tech integrations, longer driving ranges, and more competitive pricing. The Mach-E’s lukewarm reception in China underscores how brand strength alone does not ensure global success.

Tesla’s Model Y further illustrates this dynamic. Globally, the Model Y has been a consistent top-seller, becoming the best-selling EV in many European markets and solidifying Tesla’s presence in China. Local manufacturing in both regions significantly contributes to its competitive pricing and robust consumer acceptance. Yet, Tesla’s repeated attempts to enter the Indian market have largely stalled, hindered by prohibitive import duties ranging from 60-100% and the absence of domestic manufacturing capabilities. The Indian market, though promising, remains elusive for Tesla precisely due to these regional realities.

BMW offers yet another instructive case. Its fully electric iX3 crossover enjoys modest success in China, bolstered by local manufacturing through BMW’s joint venture with Brilliance Automotive. The iX3’s appeal is closely tied to its competitive positioning in China’s premium electric SUV segment, benefiting from attractive pricing and well-established brand credibility. However, BMW has deliberately withheld the iX3 from the American market, judging that its limited driving range, moderate performance metrics, and relatively high pricing would not resonate sufficiently against Tesla, Ford, and General Motors’ offerings.

Even Volkswagen’s smaller ID.3, which rapidly established itself as one of Europe’s most popular electric hatchbacks, demonstrates stark regional disparities. In Europe, its blend of affordability, practical range, and suitable size made it a bestseller, underpinning Volkswagen’s rapid EV market expansion. In China, however, the ID.3 failed to establish any meaningful traction. Facing intense competition from domestic giants like BYD, SAIC, and GAC, the ID.3 was largely overshadowed, prompting Volkswagen to rethink its approach to smaller electric models in China entirely.

These examples clearly demonstrate that EV market performance for specific models is inherently region-specific rather than universally consistent. Factors including pricing sensitivity, availability and density of charging infrastructure, local manufacturing capabilities, import tariffs, and consumer tastes all substantially shape market outcomes. Global automakers now increasingly recognize that one-size-fits-all strategies simply do not translate into global EV success.

Over the past decade, global electric vehicle sales have grown dramatically, expanding from just over 346,000 plug-in vehicles sold in 2014 to approximately 17 million in 2024, an increase of nearly 50-fold. Battery-electric vehicles alone surged from about 216,000 units to nearly 11 million units during the same period, reflecting strong market preference for fully electric models. This rapid growth, both in absolute numbers and year-over-year percentage gains, mirrors historic adoption patterns previously seen in transformative technologies such as mobile phones and broadband internet. Like mobile phones, which expanded from niche luxury products in the 1980s to near-universal adoption by the early 2000s, the electric vehicle market has evolved from a marginal category into a mass-market phenomenon, reshaping the automotive landscape within a remarkably short span of time.

While the WSJ, along with much of western conservative media, has a habit of pretending that there’s a collapse in demand for EVs, the regional variances and the strong growth statistics make it clear that while percentage growth per year varies wildly, absolute growth is on a strong upward trajectory. This looks like the classic S curve, a sigmoid, with a relatively flat initial growth pattern, than a curve upward to a rapid linear growth pattern that’s incredibly fast, followed by a return to slower growth at the end of the product’s growth cycle. While historical examples rarely follow that clean a visual pattern, at least for now this looks like a clean sigmoid is emerging from the noise. That’s radically different than declining interest.

Globally, EVs are continuing to dominate sales and have incredibly strong year over year growth. That growth percentage may be decreasing, but no one minds being in a market with 25% growth. It’s a long way from the 3-4% compounded annual growth rates that a lot of industries project to their investors and lenders as reasons to continue to provide them with money.

For investors, automakers, and policymakers, these insights are crucial. They underscore the importance of region-specific EV strategies and the risks inherent in overly generalized market assumptions. A vehicle failing in one market does not necessarily signal broader EV-market weakness. Rather, it highlights the need for more sophisticated regional analysis, and an attention to global numbers.

Viewed holistically, the global EV market is not collapsing. Instead, it is maturing, diversifying, and thriving, albeit unevenly across different geographies. Volkswagen’s ID.Buzz may indeed have disappointed in America, but this setback does not reflect global failure. On the contrary, it shows how electric vehicles are transforming into products with nuanced, targeted appeal, shaped decisively by regional market conditions.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy