Support CleanTechnica’s work through a Substack subscription or on Stripe.

A dozen years ago, in 2013, I gave a presentation at a “Renewable Cities” conference in Vancouver, Canada. The title of my presentation was “The Future Is Now,” and I argued that the benefits of electric cars and solar power lead to them seeing increasing adoption along the lines of the famous S-curve of technology adoption. A researcher and professor at Simon Fraser University had a different take. He argued that the industry would not transition in this way unless automakers were forced to do so. Consumer incentives from governments would not be enough. There needed to be strong sticks that required automakers to gradually make and sell more EVs.

Well, electric vehicle adoption has more or less gone as I expected and projected. However, this guy was definitely right. For most of the past 12 years, in places where automakers are not required to try, they generally haven’t sold many EVs. However, in markets like China and Europe, where a portion of their sales have effectively had to be electric vehicles, lo and behold, automakers have been able to find EV buyers! Funny how that works.

Well, if you’ve been following how EU regulations regarding the auto industry have been going, you don’t need this short summary, but for those who haven’t: the EU’s CO₂ regulation for cars have had increasing requirements for cutting CO₂ emissions, but it was decided earlier this year that instead of having to meet the 2025 requirements in 2025, automakers just had to reach those levels by the end of 2027. Transport & Environment has conducted an analysis of how these changes, and other things, are affecting the EV market. Let’s take a look at some of the findings.

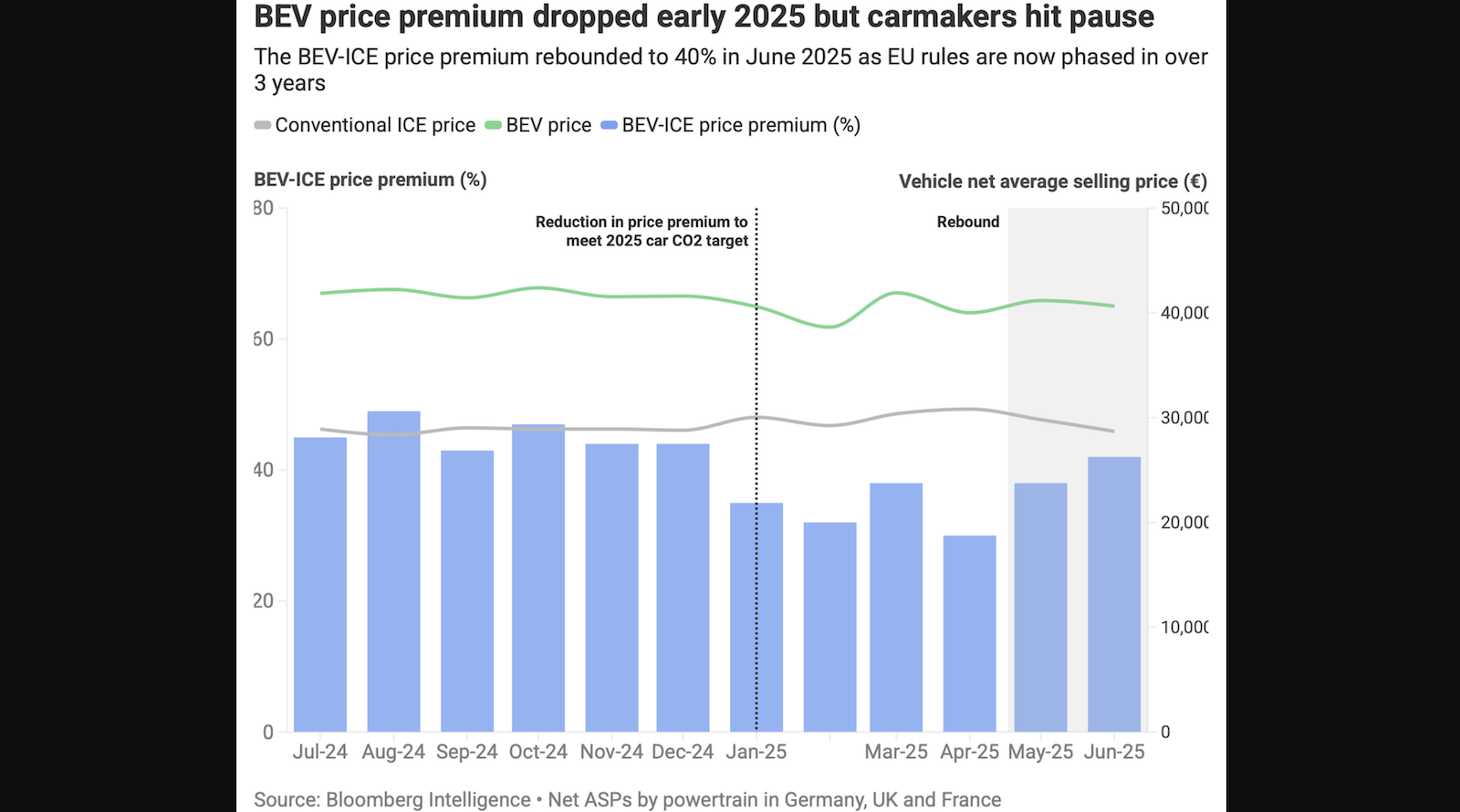

“All European carmakers are on track to comply over 2025-2027 thanks to a surge in their BEV sales – reaching 25% share over the 3-year period (18% in 2025),” T&E writes. “However, with the EU’s delay of the 2025 target, carmakers took their foot off the gas, leading to a shortfall of 2 million BEVs (over 2025–2027). Evidence shows that carmakers inflated BEV price premiums as CO2 targets got relaxed.” Wow — 2 million fewer BEV sales.

First of all, just looking at the overall forecast for the next few years, we can see that the expectation is that BEV sales will be significantly lower than they would have been if the EU had stuck to its initial CO2 emissions requirements.

Looking more closely at what has actually happened, we see that BEV prices were dropping in the first few months of the year, and after a modest increase in fossil-fueled vehicle sales, because automakers were trying to hit their 2025 CO2 emissions targets. But then the EU Commission watered down the requirements, and BEV prices bounced up again. After finally starting to narrow, the price gap between electric vehicles and fossil-fueled vehicles has widened again. It’s almost as if automakers will only fully try to sell BEVs when required to do so…. (It looks like the fellow from Simon Fraser University was right.)

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy