Procurement platform Anza Renewables has published its first quarterly US energy storage pricing insights report covering battery cell pricing, AC and DC-integrated systems, list prices and more.

Anza notes that tariffs will continue to shape pricing strategies. The figures in this report, for Q1 2025, show where the market is prior to US president Donald Trump’s 10% universal tariff on Chinese imports. Prices are expected to be significantly impacted by the tariff.

This article requires Premium SubscriptionBasic (FREE) Subscription

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The report showed that pricing decreased slightly from August 2024 to 31 January, 2025. Suppliers are adjusting quotes and deal structures to account for the import tariff. Additionally, Anza says the International Trade Comission’s (ITC’s) preliminary affirmative determination on 31 January, that Chinese active anode material will likely harm the US industry, adds further complexity to the tariff landscape.

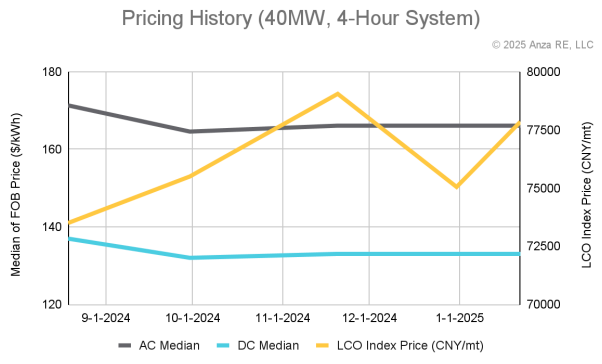

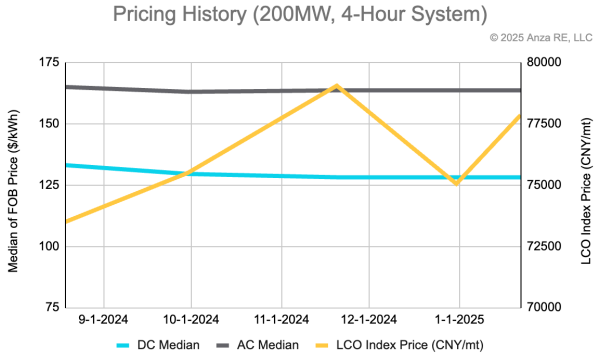

Lithium carbonate prices are levelling, helping to curb cost fluctuations in battery cell pricing. Prices climbed steadily from August through mid-November 2024, but the Lithium Carbonate Index (LCO) entered February at 77,500.

Anza’s report found more manufacturers entering the storage market than ever before, increasing competition and driving greater pricing pressure. These factors helped contribute to list prices being down from prior quarters.

AC-integrated, also known as “all-in-one” systems, are on the rise from system integrators and battery OEMs. Anza also notes a trend in DC-integrated OEM wraps contributing to pricing variability and margin compression in integration services.

US-headquartered energy storage system integrator and digital energy services provider Fluence recently launched a new AC-based modular battery storage platform for delivery in the fourth quarter of this year.

Energy-Storage.news spoke with Ty Daul, CEO of Primergy, about Gemini, a 690MWac/966MWdc solar PV plant paired with a 380MW/1,400MWh DC-coupled battery energy storage system (BESS), which sits just off the Valley of Fire highway through Clark County, Nevada.

Anza also noted the continued expansion of supplier options and volume discounts for larger projects pulling pricing downward for utility-scale projects. Meanwhile, an increase in competition from smaller project suppliers started closing the gap between distributed generation (DG) and utility-scale projects.

The company’s report includes an analysis of a 40MW, 4-hour DG system and a 200MW, 4-hour utility-scale project. The DG system analysis showed “Specifically, median AC pricing has decreased by approximately $4/kWh (about 3.0%), while median DC pricing has declined by roughly $3/kWh (around 2.9%).”

The utility-scale analysis did not show a similar shift. “Here, median AC pricing has dropped by about $1/kWh (approximately 0.8%), and median DC pricing has fallen by roughly $4/kWh (around 3.7%).”

Anza’s report shows that storage supplier pricing has remained largely the same in recent weeks but that the tariffs, which went into effect in early February and the US ITC’s affirmative determination of harm from Chinese imports of anode materials on 31 January, are all but certain to bring change to the industry, in a relatively small amount of time.

In its Q2 2024 quarterly BESS pricing survey, Clean Energy Associates (CEA) also identified increased market competition, noting a trend in the industry toward 20ft containers, along with larger battery cells of 300Ah or more.

The recently published BloombergNEF Energy Storage System Cost Survey 2024, analysing utility-scale batteries on a global level, noted that prices of turnkey energy storage systems fell 40% year-on-year from 2023 to a global average of US$165/kWh. The research firm said this was the highest annual drop since its survey launched in 2017.

BNEF found the US average price for a turnkey BESS to be US$275/kWh, breaking out its research regionally to China, the US, Europe and Rest of the World.

BNEF analyst Isshu Kikuma recently discussed trends and market dynamics impacting the cost of energy storage in 2024 with ESN Premium, noting about tariffs: “What we found is that with the 60% tariff, the cost [of a turnkey energy storage system] increases by 60% compared to 2025, so this is quite a big cost jump if the US actually decided to do so.”

BNEF is anticipating that tariffs will not slow down the growth of US energy storage deployments.

As we move into 2025, Australia is seeing real movement in emerging as a global ‘green’ superpower, with energy storage at the heart of this. This Summit will explore in-depth the ‘exponential growth of a unique market’, providing a meeting place for investors and developers’ appetite to do business. The second edition will shine a greater spotlight on behind-the-meter developments, with the distribution network being responsible for a large capacity of total energy storage in Australia. Understanding connection issues, the urgency of transitioning to net zero, optimal financial structures, and the industry developments in 2025 and beyond.

The Energy Storage Summit USA is the only place where you are guaranteed to meet all the most important investors, developers, IPPs, RTOs and ISOs, policymakers, utilities, energy buyers, service providers, consultancies and technology providers in one room, to ensure that your deals get done as efficiently as possible. Book your ticket today to join us in 2025!

ac-coupled, anode, anza, battery, battery pricing, china, dc-coupled, distributed generation, energystorageusa, international trade comission, lithium carbonate, oem, pricing, tariff, usa, utility-scale

Read Next

US branch of PCR S.A. has cleared important hurdle in development of a hybrid solar and BESS project in Sandoval County, New Mexico.

Trina Storage has agreed a deal with Pacific Green to support the development of the 250MW/500MWh Limestone Coast North Energy Park battery energy storage system (BESS) in South Australia.

BESS deployment data for 2024 and forecasts for 2025 have been released by BloombergNEF and the Energy Information Administration (EIA) respectively.

California High-Speed Rail Authority (CHSRA) has commenced the permitting process for a 265MWh hybrid solar and BESS project.