CATF recently published a report entitled Beyond LCOE: A Systems-Oriented Perspective for Evaluating Electricity Decarbonization Pathways advocating for a shift in how we evaluate energy technologies. At face value, their core criticism, that Levelized Cost of Electricity (LCOE) alone does not capture the full economic complexity of integrating intermittent renewable resources, is both true and widely accepted. LCOE is certainly an incomplete metric, since it ignores system-level costs like storage, flexibility, transmission, and capacity value.

However, CATF’s suggested solutions, which heavily favor inflexible generation only suitable for no-longer-useful baseload such as nuclear, enhanced geothermal systems (EGS) and carbon capture-equipped fossil plants, or incredibly expensive hydrogen turbines, suffer from serious biases that undermine the credibility of their conclusions.

While it is true that relying solely on LCOE can lead to misunderstandings about the real-world economics of renewable integration, CATF pushes too far in the other direction. They demand rigorous accounting for the integration and firming costs of intermittent renewable energy like solar and wind, yet conveniently gloss over or downplay significant system integration costs associated with their preferred technologies.

Nuclear power, often portrayed by CATF as an ideal firm technology, is inherently inflexible due to a combination of technical and economic factors. Nuclear plants achieve economic viability by running continuously at steady output levels. Any attempt to vary their output significantly reduces efficiency and increases operational stress and maintenance requirements. This inflexibility requires substantial supplementary investments in flexibility services, notably pumped hydro storage facilities, to absorb excess generation during low-demand periods, typically at night.

Approximately 90% of global legacy pumped hydro storage was built primarily to manage nuclear’s inflexible output patterns. CATF acknowledges nuclear’s firm characteristics but inadequately addresses the accompanying necessity and cost of these flexibility services.

Enhanced geothermal systems (EGS), another geothermal technology strongly favored by CATF, similarly suffers from inherent inflexibility. EGS operations depend heavily on maintaining steady-state thermal reservoirs and sustained high-capacity factors. Realistic future cost projections place EGS around $250 per MWh at a 90% capacity factor. However, this estimate does not account for additional expenses associated with integrating inflexible geothermal output into dynamic grid conditions, such as necessary pairing with battery storage or flexible hydro assets to manage variations in demand and grid stability. CATF downplays or ignores these real integration costs, effectively misrepresenting EGS’s full economic profile.

Another preferred CATF solution, superhot rock geothermal, as championed by companies such as Quaise, is frequently portrayed as a potentially transformative clean energy source. However, the practical challenges associated with this technology bear significant resemblance to a collection of black swans, events of low probability but exceptionally high impact. Quaise proposes drilling depths approaching 20 kilometers using millimeter-wave drilling technology to access supercritical geothermal resources at around 400 degrees Celsius.

These ambitions face severe technical hurdles, including borehole integrity issues, the difficulty of maintaining electronics at extreme depths and temperatures, and unproven materials capable of withstanding repeated thermal cycling and immense subterranean pressures. Each incremental depth compounds complexity, introducing unpredictable engineering and geological risks. This isn’t even a solution yet, so it’s even more speculative than the expensive and still not operational EGS, yet CATF cites it as an example of “useful” firm generation.

Fossil generation with carbon capture and storage (CCS) also faces severe limitations in flexibility. CCS plants experience significant efficiency losses, increased complexity, and higher capital and operational costs due to carbon capture processes. The process of capturing, compressing, transporting, and sequestering carbon dioxide severely constrains operational flexibility. Rapid cycling or ramping of CCS plants exacerbates mechanical stress and leads to increased maintenance and reduced lifespan.

The use of CCS on biomass-powered coal plants was a point of discussion in the TenneT 2050 scenario planning exercise I was involved in that concluded today. Putting CCS on any thermal generation means that the thermal generation has to run with 90% capacity factors to begin to pay for the CCS component capital costs, so it’s not even worth putting on plants burning biomass. There are cold, pure streams of biogenic CO2 from industrial processes that are worth capturing where there are sequestration sites handy, but there is no merit in bolting CCS onto thermal generation post-combustion.

CATF consistently minimizes these complexities and expenses, presenting CCS as a straightforward firm technology without adequately accounting for substantial flexibility integration costs.

Hydrogen turbines, meanwhile, theoretically offer flexible dispatchability but confront daunting economic realities. Hydrogen generation from renewable electricity involves substantial energy losses due to electrolysis inefficiencies, storage requirements, and reconversion back to electricity. This cumulative round-trip inefficiency significantly increases actual delivered electricity costs and undermines its practical flexibility potential at scale.

Another frequently cited misconception leveraged in anti-renewables analysis, and included in the CATF report, is the supposed land-use superiority of nuclear power over renewables. Advocates of nuclear energy often claim significantly lower land footprints compared to solar and wind installations, ignoring the fact that land-use considerations are already explicitly accounted for in LCOE calculations. Solar and wind developers incorporate land acquisition and permitting costs directly into their project economics, reflected transparently within their LCOE.

Nuclear projects, meanwhile, typically exclude extensive land-use implications such as the sizable exclusion zones, buffer areas, and substantial land dedicated to mining and waste management. Claiming that renewables are a problem because of land use, then low-balling nuclear land requirements and ignoring economics is par for the level of discourse from CATF.

Not content with misleading assertions about land use and nuclear, CATF also cites fusion as a firm generation source. It has become the punchline of clean energy, perpetually “just 20 years away” for the past 70 years. As a supposed firm generation solution, it’s a fantasy more suited to interstellar propulsion than terrestrial decarbonization. The reactors are engineering nightmares, demanding magnetic fields stronger than anything nature provides and containment systems that make nuclear fission look quaint. Breakthrough Energy Ventures keeps throwing money at fusion startups as if climate timelines operate on science fiction logic. If fusion ever works, and that’s a galactic if, it’ll be powering spaceships near the moons of Jupiter, not stabilizing grids in Peoria. It’s not an energy transition strategy; it’s a billionaire vanity project in disguise.

LCOE, despite its limitations, remains valuable precisely because it provides a transparent, standardized, and easily understood initial comparison among generation technologies. It establishes a baseline from which more sophisticated and system-level analyses can build. Arguing against its utility outright risks dismissing a valuable tool that, while imperfect, is foundational for comparative cost analysis. The solution is not to discard LCOE but rather to complement it transparently with integration and flexibility costs for all technologies, not just renewables.

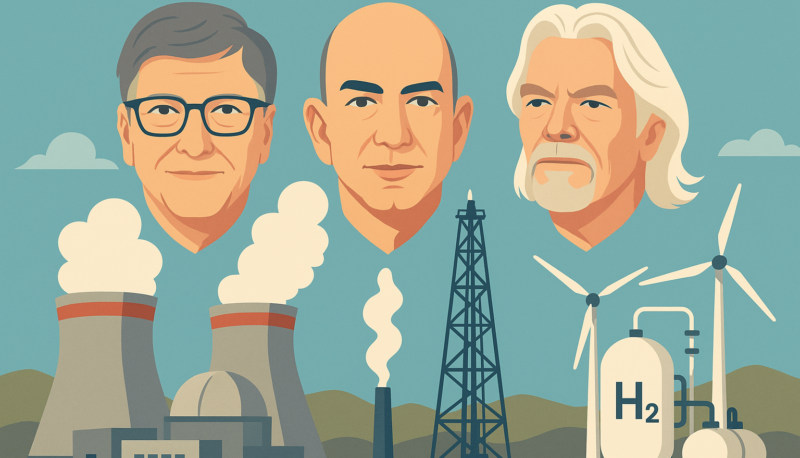

The biases in CATF’s conclusions are not accidental. The organization’s funding and institutional alliances strongly align with entities heavily invested in nuclear, carbon capture, and hydrogen technologies. Prominent backers, such as Breakthrough Energy Ventures and Quadrature Climate Foundation, have publicly promoted these specific firm generation solutions. This alignment suggests an inherent motivation to frame analyses that favor these technologies by emphasizing renewable energy’s system-level challenges while simultaneously obscuring their own.

Examining the portfolio of Breakthrough Energy Ventures, a primary funder behind CATF, as I did last year reveals similar biases towards firm, capital-intensive technologies. Many investments in their portfolio align closely with the solutions CATF emphasizes, such as advanced nuclear reactors, carbon capture and storage systems, and hydrogen production and storage infrastructure. This investment approach suggests a clear preference for technologically complex solutions that often rely heavily on substantial infrastructure development and have lengthy deployment timelines.

This alignment further underscores the potential influence on CATF’s analytical stance. The prominence given to these particular technologies in both Breakthrough Energy Ventures’ investment strategy and CATF’s recommendations highlights an institutional bias toward high-cost, firm generation sources. This financial and strategic convergence inevitably shapes the framing of CATF’s conclusions, encouraging selective emphasis on the limitations of intermittent renewables while minimizing the substantial integration and flexibility costs of the technologies they favor.

The billionaires behind Breakthrough Energy Ventures, including Bill Gates, Jeff Bezos, and Richard Branson, initially shaped their investment strategies and energy perspectives in the early 2000s, when wind, solar, and batteries had not yet achieved significant scale or cost reductions. At that time, nuclear power and other high-cost, firm technologies appeared as the only credible pathways for decarbonization. Despite the transformative growth and substantial cost declines in renewable technologies since then, their original biases towards nuclear and complex, capital-intensive technologies persist, and none of their sycophantic adherents are going to correct them.

This failure to revise outdated assumptions has guided Breakthrough Energy Ventures’ ongoing investments, and by extension, influenced CATF’s analyses and recommendations, perpetuating an outdated narrative that no longer aligns with today’s energy realities.

Ultimately, the CATF report represents a missed opportunity. Its legitimate critique of LCOE’s limitations becomes overshadowed by a biased advocacy for expensive, inflexible, and still largely unproven technologies. Policymakers and investors genuinely seeking robust economic analysis of clean energy options deserve transparency and completeness, not selectively framed narratives. A fair approach would transparently include all flexibility and integration costs alongside the basic LCOE for every technology, ensuring balanced comparisons rather than biased advocacy.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy