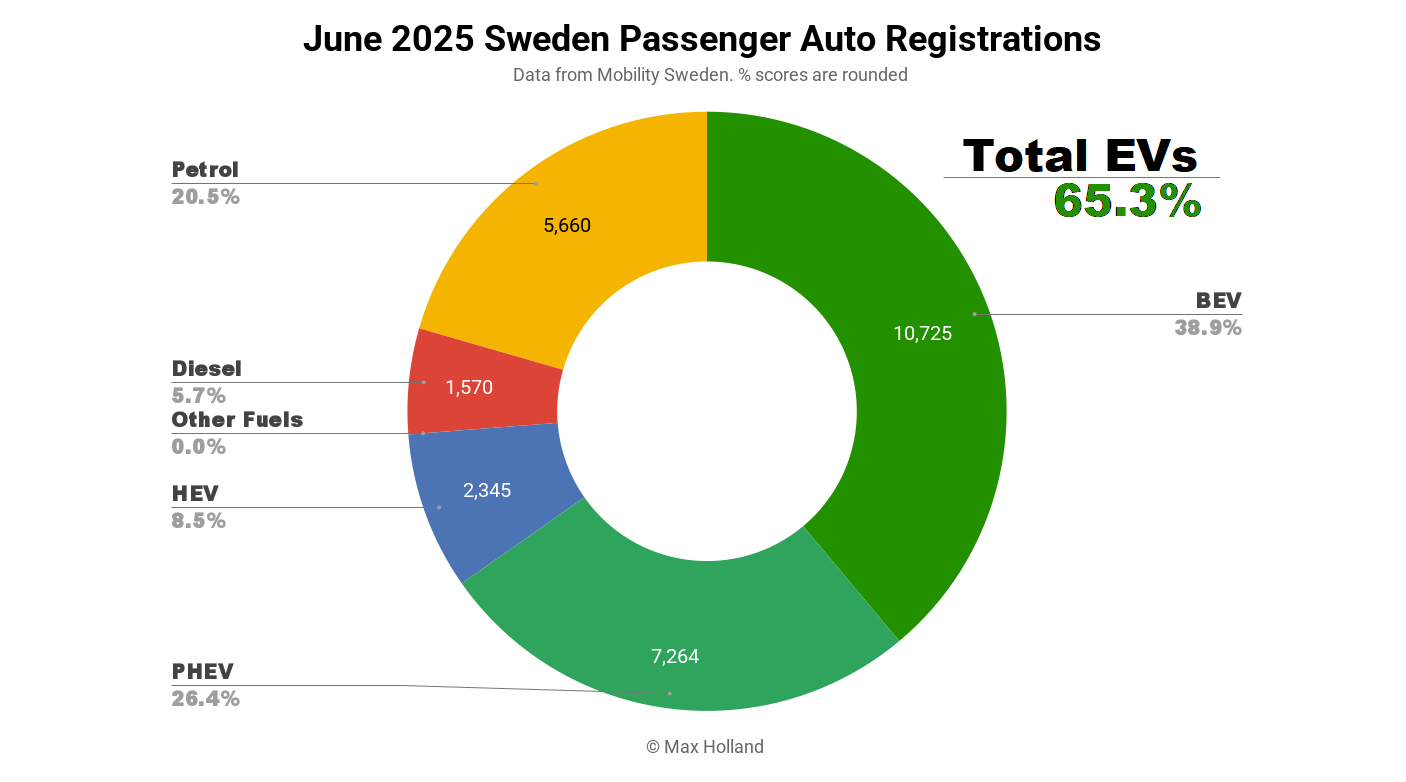

June saw plugin EVs take 65.3% share in Sweden, up from 56.5% year-on-year. Both BEVs and PHEVs grew volume whilst all other powertrains declined. Overall auto volume was 27,565 units, up 10% YoY. The Tesla Model Y was the best-selling BEV in June.

June’s auto sales saw combined plugin EVs take 65.3% share in Sweden, with full battery-electrics (BEVs) at 38.9%, and plugin hybrids (PHEVs) at 26.4%. These shares compare YoY against 56.5% combined, with 35.9% BEV, and 20.6% PHEV.

June saw a decent YoY uptick for plugins, both BEV and PHEV, though note that the 2024 baseline was weak. For a broader perspective, the 35.2% year-to-date BEV share is still down compared to the same period in 2023 (37.3%), as is YTD volume (49,667 vs 52,445 units).

It’s tempting to blame this BEV stagnation over the two years simply on Tesla’s volume drop in Sweden (3,586 vs 10,260 units YTD). But the transition’s reliance on a single brand exposes the lack of a mature BEV market, and weak efforts by legacy auto (enabled and protected by tariffs on Chinese brands).

The stagnation in EV progress is also enabled by the recent back-sliding of EU emission regulations, in a move designed to appease legacy auto and protect their short-term profits coming from past ICE investments, at the expense of emissions, pollution and citizens’ health.

That the European political class has instead switched attention (and funding) to military production, whilst simultaneously supporting settler-colonial genocide in Gaza, just highlights that a culture of supremacism and hubris is a poor foundation for a sustainable society.

Best-Selling BEVs

After a slow start in getting the refreshed Tesla Model Y moving in volume, it finally stepped up somewhat in June, and (narrowly) took the lead with 869 units. The recent favourite Volkswagen ID.7 took second place, with the Volvo XC40 in third.

Somewhat surprisingly, the new Skoda Elroq fell back in volume in June, and slipped outside the top 20. This is likely just a temporary allocation drop, however, as the Elroq is still climbing strongly in other European markets.

The MG brand had a strong month, with both the MG5 and MG4 having their highest volumes in almost two years.

There were two BEV debutants in June. The new Smart #5 arrived, with a modest 4 units. Don’t expect too much from this model, as Smart is not really pursuing the Swedish market currently, with just 16 units (across all models) delivered so far in 2025. The Smart #5 is a D-segment SUV (with a length of 4,705 mm), starting from 566,800 SEK (50,800€).

The Opel Frontera also saw its first registrations, with 6 units in June. This is no longer a new model, having debuted 9 months ago in Germany. Apart from modest volumes in commercial vans, Stellantis is not currently prioritising the Swedish market, so don’t expect to see many Fronteras on the roads in the near future. Even Stellantis’ Citroen e-C3 has only shown up in very low volumes (under 20 units per month on average), since its Swedish debut in February.

The Lynk & Co 02 was absent in June, following its 104 unit debut in May. By contrast, its group-cousin, the new Zeekr 7x, stepped up to a healthy 132 units from 86 units in May.

Checking in on the small-and-affordable segments, the Renault 5 increased modestly to 134 units in June (from 121 in May). The Hyundai Inster was lacklustre, at just 4 units, and hasn’t yet seen a bigger month than its modest debut back in February (37 units).

The leading B-segment BEVs continue to be the Kia EV3 and the Volvo EX30, but neither are affordable. Since Stellantis is barely operating in Sweden, it would be unwise to hope that the e-C3 Aircross will have much impact here, certainly in the near term. Unfortunately, BYD is also not yet prioritising growing its business in Sweden, so the Dolphin Surf won’t quickly change things.

The best new hope for B-segment in the near term is for the Renault 4 to arrive and gain traction. I expect its elevated “SUV” format has a chance at greater success in Sweden than the hatchback Renault 5, but it will scarcely be affordable in any true sense (likely starting around 30,000€).

Let’s get an update on the trailing 3 month rankings:

The Volkswagen ID.7 retains the top spot for the 4th consecutive month, with the Volvo XC40 holding steady in second place.

The Volkswagen ID.7 retains the top spot for the 4th consecutive month, with the Volvo XC40 holding steady in second place.

After a slow Q1, the Volvo EX30 had a stronger Q2 overall and climbed to third spot, displacing the Tesla Model Y down to fourth, despite the latter’s lead in June. One good month, amongst two weak months, is not enough to shine in this chart. Let’s see if the Model Y’s increased volumes in June are the start of a recovery, or just a blip aided by the end of the quarter.

Further back, the Polestar 4 has just had its three strongest months of the year, and climbed to 6th in Q2, from 11th in Q1, doubling its volume over the prior period. Likewise, the Audi A4 e-tron, which had only just debuted in Q1, climbed well to 11th spot in Q2.

Despite the new Skoda Elroq not seeing much volume growth over the past two months, it has nevertheless just scraped into the top 20, in 18th spot. In most other markets (and overall in Europe) it has already overtaken its sibling the Enyaq, but it has not yet done so in Sweden and Norway.

The Renault 5 remains outside the top 20 for now, in 26th. It will need to sustain an average of around 150 units per month in order to climb into the top 20, and is not yet quite there (134 units in June). On its current trajectory, it could possibly join by the end of September. Let’s keep an eye on it.

Outlook

Swedish auto volume has grown 6.5% year to date, and plugins have outperformed with 18.4% YoY growth. HEVs have also grown (by some 15%), while combustion-only vehicles (and notably the previous “ethanol” classification) have lost out. 2024 was a weak benchmark however, and plugin volume is still some way down from 2023’s YTD total. Put simply, Sweden’s transition is still moving at a snail’s pace.

For context, the broader economy remains lacklustre, with 2025 Q1 GDP data (latest available) recording just 0.9% YoY growth. Headline inflation increased from 0.2% in May, to 0.8% in June, and interest rates finally saw a trim from the previous 2.25% down to 2.0% in mid June. Manufacturing PMI fell to 51.9 points in June, from 53.6 points in May.

What are the underlying reasons for Sweden’s transition slowdown since the end of 2023? What will it take to get it back on track? Please share your thoughts and perspectives in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy