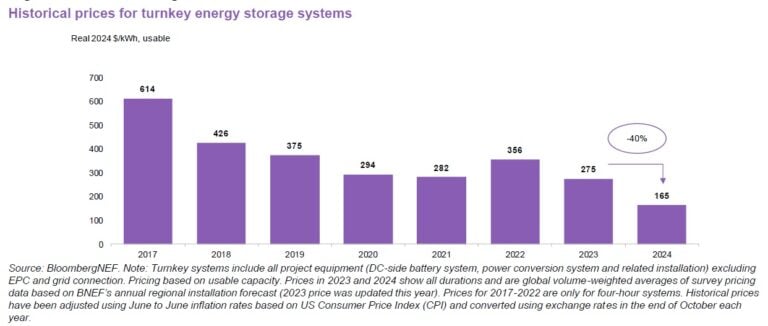

This was the biggest drop since BNEF began its surveys in 2017 and therefore, safe to say, likely the biggest yearly reduction in history. The mid-pandemic price spikes, which arrested the decline in costs due largely to the relative scarcity of lithium carbonate, already feel a long time ago in a way.

However, while the falling prices of materials significantly helped along the drop last year (also evident in a 20% fall in average battery pack prices), there are a myriad of other factors which have driven that reduction, BNEF energy storage analyst Isshu Kikuma says.

The research mainly collected pricing information from the world’s biggest battery energy storage system (BESS) markets: China, the US and Europe. The remaining 17% of data was gathered from other markets, including South Korea, India, Japan and Australia.

There were some significant regional trends and differences in the global market BNEF observed. Perhaps the most obvious is that turnkey systems—defined as systems including battery rack subsystem (DC side or DC block), power conversion system (PCS) and energy management system (EMS)—are considerably cheaper in China than anywhere else.

Cheaper by far in China

It is nonetheless still eye-opening to note just how big those differences in cost are. The average for a turnkey system in China including 1-hour, 2-hour and 4-hour duration BESS was just US$101/kWh.

In the US, the average was US$236/kWh and in Europe US$275/kWh, more than double China’s average cost.

“This showcases how we are seeing quite aggressive cost reduction in China, partially because of the overcapacity of battery production in China. On top of that, China has quite fierce competition within the energy storage market,” Kikuma says.

“Additionally, if you look at global installations of energy storage systems, China accounts for about half annually. So, I think the scale is also gigantic.”

That combination of factors accounts for the big discrepancy, and Kikuma notes that even at the high end of the price in China, at US$174/kWh, costs were still lower than even the lower end costs in the US or Europe.

For many years, the industry had wondered when the US$100/kWh mark would be breached at the low end. In China, it happened for the first time in 2024, according to BNEF, with a 4-hour duration turnkey system costing US$85/kWh on average.

Downstream, as reported by Energy-Storage.news, recent tenders in China have been held in which winning bids for BESS projects as low as US$66/kWh were entered, which Kikuma says were in broadly in line with BNEF’s numbers.

In a recent article for our quarterly journal PV Tech Power (Vol.41), Iola Hughes, head of research at battery market analyst Rho Motion referred to the highly competitive landscape among Chinese players.

Asked whether that level of competition is sustainable for the world’s biggest battery-producing country and the world’s biggest energy storage market, Isshu Kikuma says: “it’s a very tough position for a lot of companies in China.”

“In terms of battery production, even though many of the companies are experiencing low utilisation rates of their manufacturing plants, many companies are still tapping into the BESS market, because the market size is growing,” Kikuma says.

“The domestic market in China is very big, but [also] I think globally, because the market is growing, many battery manufacturers or battery system integrators are trying to tap into the market and benefit from those growing business opportunities,” Kikuma says.

“So, in terms of competition, it’s tough, and I don’t think it’s sustainable, but still, many market players are joining the market.”

Some players, particularly new entrants, are offering very competitive prices in order to gain market share and brand awareness, putting those goals before big profits, at least in the immediate term.

US costs fall below Europe’s

BNEF predominantly looked at the markets for 2-hour and 4-hour duration systems, which comprise the most significant share of new projects.

Longer-duration systems of 4-hours are cheaper than 2-hour, as some non-battery components such as PCS and transformers are priced in dollars per kilowatt rather than dollars per kilowatt-hour.

Kikuma says that one interesting trend the survey identified in the next two biggest regions after China was that while systems were cheaper in Europe in 2023, last year, the US overtook—or indeed undercut—European prices for 2-hour and 4-hour turnkey systems.

“If we look at the historical trends, the US used to be more expensive than the European market, but in this year’s results, the price in Europe was actually more expensive.”

This is likely due to the distribution of data and survey information BNEF collected: US market information included a much higher proportion of systems utilising larger-format battery cells and more energy-dense 20-foot containers, which, as we saw in a news story last week from Kikuma’s interview, are cheaper on a per-kilowatt-hour basis than those with cells smaller than 300Ah and containers with less than 5MWh capacity.

While a casual observer might wonder if the Inflation Reduction Act (IRA) tax credit incentives might also play into a lower-cost environment in the US, Kikuma says the cost analysis excludes tax credit benefits.

‘US needs more manufacturing capacity to meet domestic demand goals’

All of the pricing information BNEF collected for the US was based on Chinese BESS imports, which, again, is unsurprising due to the dominant position of China in the global industry.

Still, Kikuma says that other research BNEF has undertaken shows that the cost of US-made batteries or energy storage systems will still be in a much more expensive price range than the imports.

The agenda to promote domestic manufacturing in the US was a big ticket item under the presidency of Joe Biden, and the early indications from the second Trump presidency are that local supply chains will be a big topic this year, Kikuma says.

That means that while attempting to erase policy support for clean energy from the Biden-era and further back appears to be a big priority for the Republican president, Kikuma thinks the Advanced Manufacturing 45X credit and domestic content bonuses for the Investment Tax Credit (ITC) may be “facing less risk compared to other uncertainties.”

Nonetheless, as we have heard previously from various sources, fostering a US-based battery and energy storage system supply chain at scale will be a challenge, and this was the case even under the Democrats.

“We did some analysis looking at our deployment forecasts for energy storage systems and compared that to announced manufacturing plans within the US for lithium iron phosphate (LFP) cells specifically for energy storage systems, and we found that, basically, the US doesn’t have enough,” Kikuma says.

“The US definitely needs more manufacturing capacity if all of the projects need to source domestically produced battery cells.”

Tariffs won’t stop US market momentum

Of course, slapping tariffs on imported goods has also been high on Trump’s agenda in the first fortnight of his current term.

While our conversation took place a few days before the US president’s latest wave of tariff announcements on Mexico, Canada, and, of course, China, the hiking of import tariffs had been a distinct possibility that Isshu Kikuma and his team at BNEF had modelled.

Tariffs rises were on the table for whichever candidate had won the election since Biden had, prior to stepping down from the race for Kamala Harris, announced a rise in Chinese battery import duties from 7.5% today to 25% beginning in 2026, and the industry was already making preparations for that.

BNEF modelled forecast scenarios reflecting both that planned 2026 rise in Section 301 tariffs, as well as a potential extra 10% hike on top, and a more extreme outlook reflecting a 60% tariff rate being placed on battery racks imported from China in 2026.

“What we found is that with the 60% tariff, the cost [of a turnkey energy storage system] increases by 60% compared to 2025, so this is quite a big cost jump if the US actually decided to do so,” Kikuma says.

That means costs in 2026 would return back to 2024 levels which could slow down the growth in US energy storage deployments, but the analyst says that even so, BNEF anticipates that the momentum of the country’s energy storage industry and growth in deployments would remain strong.

Fire safety doesn’t mean prohibitive cost increases

One trend that is perhaps universal to the global energy storage industry is an increased focus on fire safety, even if it’s one that is currently being felt more acutely in the US than elsewhere due to the recent high-profile fire at Moss Landing Energy Storage Facility in California.

Isshu Kikuma says that although BNEF didn’t include the possibility of increased costs for fire suppression or prevention equipment into its forecasts, it is a topic the analysts have discussed with survey participants.

“If the US or California decided to modify [fire safety] restrictions or requirements, it will likely add some cost to energy storage systems,” he says.

“Many of the participants stated that, yes, it will increase the cost, but in terms of the overall cost, [the impact] will be very minimal, so they don’t think that will be a threat or anything that will stop the deployment of energy storage systems or stop cost reduction completely.”

Ultimately, as previously mentioned, cost reductions are coming from multiple angles, from materials and battery costs to increased competition and advances in cell technology and enclosure energy density.

Kikuma says that some additional technology trends to look out for may include a shift towards higher voltage systems above 1.5kV and increased adoption of liquid-cooling technologies, which can be more efficient than HVAC in enabling higher energy density.