Multiple factors are driving that cost reduction, including falling materials prices and increased competition between Chinese battery cell manufacturers. It will perhaps be no surprise that costs remain significantly lower in China than in the US and European markets—by about 60% for turnkey energy storage systems (ESS) at all durations from 0.5-hour to 4-hour.

BloombergNEF (BNEF) found 2024 prices for 4-hour duration turnkey systems in China to average US$85/kWh, falling beneath US$100/kWh for the first time.

One recent 16GWh BESS tender run by state-owned EPC firm China Power Construction Group saw bids averaging at US$66.3/kWh while another competitive solicitation from oil and gas firm PetroChina received bids ranging from US$59/kWh to US$139/kWh for the 2.5GWh of contracts on offer, as reported last week by Energy-Storage.news.

ESN Premium spoke with Isshu Kikuma, energy storage analyst at BNEF about the report. In a wide-ranging interview to be published in full next week, Kikuma said that based on data collected through the year and conversations with market players, a significant overall cost reduction had been expected.

“We knew last year’s result was going to be much lower than the previous year’s number, so in that sense, it wasn’t a surprise, but obviously 40% is really big,” Kikuma said.

The scale of the reduction suggests that in addition to the falling cost of batteries—BNEF’s recent Lithium-ion Battery Price Survey found that battery pack prices fell 20% year-on-year to 2024, again the biggest drop recorded to date—energy storage system providers are working on cost reduction in other areas, Kikuma said.

This could include reducing margins or finding more cost-competitive suppliers of equipment for non-battery components, such as power conversion systems (PCS) and other balance of plant.

“Overall, there’s a huge push towards cost reduction in the market on top of falling material or battery prices,” Kikuma said.

Bigger cells

On the battery side however, the impact of more and more cell manufacturers moving to offering >300Ah lithium iron phosphate (LFP) cells is one of the factors pushing costs downward.

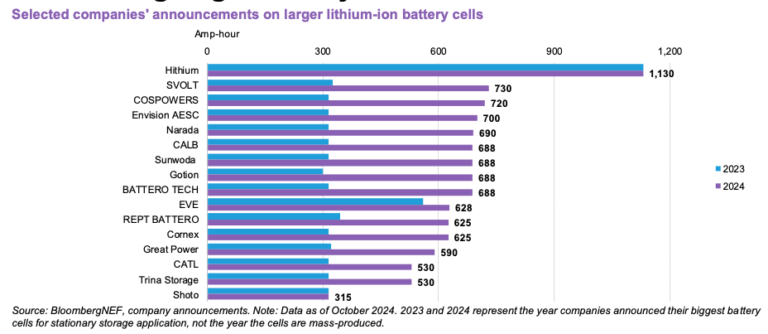

As shown in the chart above, a range of major manufacturers have announced larger format cells. Kikuma points out that the chart shows the year the companies announced their biggest battery cells and not the date for which mass production will begin.

Nonetheless, he said, it “clearly shows that a lot of battery manufacturers are moving to much bigger battery cells, which are more energy dense and contribute to the cost reduction of the energy storage system.”

For DC-side systems, systems with 300Ah or larger cells were 5% cheaper than systems with 300Ah or smaller cells in 2024. DC blocks with <300Ah cells averaged at US$144/kWh versus US$137/kWh average for 300Ah or larger. BNEF also asked survey participants to specify the delivery year of their systems, and through that was able to forecast an even bigger drop in 2025, to an average of US$122/kWh for DC blocks with 300Ah or bigger cells.

“A lot of people are thinking about bigger battery cells. One of the questions we ask in the survey is [around] what the factors will be that could contribute to cost reduction now, or going forward. One of the most frequent answers was actually bigger battery cells,” Kikuma said.

More energy-dense containers

Driven by bigger cells sizes and other technology advances, the industry is also increasingly seeing 20-foot BESS containers with 5MWh storage capacity from system integrators and vertically integrated battery manufacturers. Some are even exceeding that capacity, such as CATL with its 6.25MWh Tener solution.

ESN Premium took a deep dive last July into the industry’s convergence around the 5MWh 20-foot form factor. While Chinese integrators like CATL took the lead, western system integrators like Powin, Fluence and Wärtsilä have all followed suit and various BESS developers and asset operators—the system integrators’ end-customers—commented that the higher energy density systems were the only viable product for their projects.

Market intelligence firm Clean Energy Associates (CEA) said in its own ESS Price Forecasting Report, produced quarterly, that the 5MWh units are easier to ship, and cheaper on a kilowatt-hour basis than their less energy dense counterparts.

Similarly, BNEF found in its annual survey that BESS DC blocks in 4MWh or larger enclosures came in 27% cheaper on average than those in the 2MWh to 4MWh range, at US$128/kWh versus US$176/kWh. The firm’s survey found that the price differential is expected to continue into 2025.

Limits to how far the trend might continue

Although we have seen cell sizes and DC block energy density continue to increase—Hithium for example has announced, although not yet mass produced, 1,000Ah+ cells and EVE Energy has begun mass production of 628Ah cells—there may be some limitations to pursuing bigger and more energy dense solutions on a similar trajectory going forward.

“Many people are moving to larger battery cells, but there are some restrictions around making the battery cells bigger and bigger,” Isshu Kikuma said.

The first of those is safety. While a larger battery cell may not be any more likely to experience thermal runaway that results in fire than a smaller cell, the consequences of any fire incident that does occur may be bigger, Kikuma said.

“Another challenge would be whether transport or shipment will be as easy as [with] the current size of the battery cells. If you make the battery cells bigger and bigger, energy density will be higher, which contributes to increased weight.”

That could produce a “huge bottleneck” for site logistics, Kikuma said, “especially when you’re trying to transport these battery cells from one place to another. I think this will be one of the bottlenecks when we think about making the battery cells larger and larger.”

In early 2024, ESN Premium also heard from various sources that in addition to the logistics and fire safety considerations of increased energy density solutions, the amount of noise produced by the more intensive cooling systems required may also be a challenge for siting and permitting some projects.