CATL has filed a complaint in a US court against system integrator Powin for alleged non-payment for shipments of battery cells for BESS.

China-headquartered lithium-ion (Li-ion) battery manufacturer CATL has submitted a ‘petition for provisional measures in aid of arbitration’ against Powin in the Circuit Court of Oregon, dated 17 December, 2024.

This article requires Premium SubscriptionBasic (FREE) Subscription

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The complaint relates to payment for lithium-ion batteries CATL provided to Powin during 2023, and CATL claims that Powin owes it around CNY310 million (US$44 million).

The companies’ co-operation covered by Energy-Storage.news dates back as far as 2020. Powin declined to comment while CATL has not responded to our request for comment.

Alleged non-payment for two separate orders

In its statement of facts, CATL said that Powin’s local Chinese subsidiary Yangzhou Finway Energy Tech Co (Finway) issued purchase orders to CATL for battery cells which it shipped to the company over 2022, for onward transportation to Oregon, US.

CATL said Powin defaulted on payment for these batteries, and the firm emailed Finway detailing the overdue payments on 13 April 2023. A term sheet entered into in June saw Powin acknowledge overdue payments totalling CNY91 million (US$12.5 million) for 2022 deliveries, agreeing to pay it by 31 October that year.

CATL then fulfilled a further order for batteries after that term sheet for which Powin paid a 10% deposit but failed to pay the remaining 90%, totalling CNY216 million (US$29.7 million).

Plus contractual liquidated damages, CATL said it is now owed a total of CNY310 million for the non-payments of batteries shipped in 2022 and 2023. That equates to US$44.3 million, CATL said (slightly lower with the exchange rate at the time of writing this article).

The companies’ agreements stipulated that disagreements would be arbitrated in a court in Hong Kong. CATL said that it filed a notice for arbitration for that amount in August against Powin and its Finway affiliate, but that Powin had not provided any explanation of the non-payments.

Powin has also, CATL says, been ‘dissipating’ its assets in China including vacating various addresses Finway was registered at. This means that CATL needs an attachment against Powin’s Oregon-based assets and properties, including CATL’s battery cells and real property. In law, ‘attachment’ means the designation of assets that can be seized by a creditor or claimant.

Powin and CATL

Powin procures batteries from a variety of manufacturers other than CATL, and in the past year has announced supply agreements with other China-based lithium-ion battery manufacturers Eve Energy, Rept and Hithium. Last week, we heard from Powin’s CTO for our Year in Review series, while this morning we published an interview with some of the company’s partners on the Waratah Super Battery BESS project in Australia, which it deployed (Premium access).

Alongside lithium-ion cells for BESS and EVs, CATL also has its own grid-scale BESS product line. The latest product is called Tener, for which it claims no degradation for the first five years of operation, discussed in a recent interview (Premium access). The firm is the largest lithium-ion manufacturer in the world.

As we move into 2025, Australia is seeing real movement in emerging as a global ‘green’ superpower, with energy storage at the heart of this. This Summit will explore in-depth the ‘exponential growth of a unique market’, providing a meeting place for investors and developers’ appetite to do business. The second edition will shine a greater spotlight on behind-the-meter developments, with the distribution network being responsible for a large capacity of total energy storage in Australia. Understanding connection issues, the urgency of transitioning to net zero, optimal financial structures, and the industry developments in 2025 and beyond.

The Energy Storage Summit USA is the only place where you are guaranteed to meet all the most important investors, developers, IPPs, RTOs and ISOs, policymakers, utilities, energy buyers, service providers, consultancies and technology providers in one room, to ensure that your deals get done as efficiently as possible. Book your ticket today to join us in 2025!

Read Next

Barrett Bilotta, president and CEO at Agilitas Energy, contributes to our Year in Review series, touching on industry growth in 2025, evolving wholesale market rules and an anticipated shift away from lithium-ion battery technology.

Portugal has selected 43 winning BESS projects for a share of €100 million (US$105 million) in EU grants while, on the other side of Europe, Moldova has launched a 75MW BESS procurement with funding from USAID.

Following his inauguration on Monday morning, US president Donald Trump signed a raft of executive orders outlining his administration’s plans for the next four years.

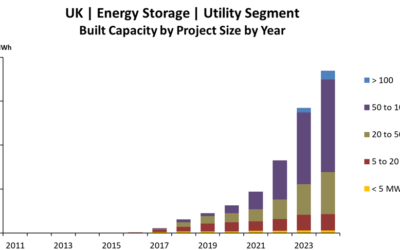

The UK saw a slowdown in both BESS installations and submitted applications in 2024, while applications in Ireland grew by capacity, writes PV Tech Research analyst Charlotte Gisbourne.