The European energy storage market is entering a new phase of maturity

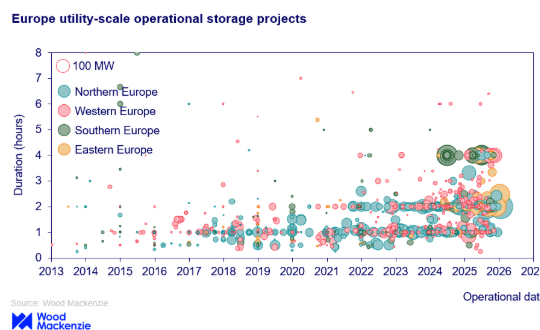

In Europe, average project sizes have been increasing year-on-year, with only a 15% increase just in 2025, signalling that battery storage is transitioning from niche technology to essential grid infrastructure.

The pipeline shows unprecedented momentum, with more projects expected online in 2025-2026 than the entire previous decade combined. While 1-2 hour duration systems still dominate, activity in longer-duration storage (4+ hours) is accelerating, driven by the need for grid stability and renewable energy integration.

The shift toward 100+ MW projects across all regions confirms that energy storage is no longer experimental but has become critical infrastructure for Europe’s energy transition. As growth spreads beyond traditional strongholds in the UK and Germany, the next phase will test whether emerging markets can overcome regulatory and financing hurdles to match the operational momentum of their more established energy storage markets.

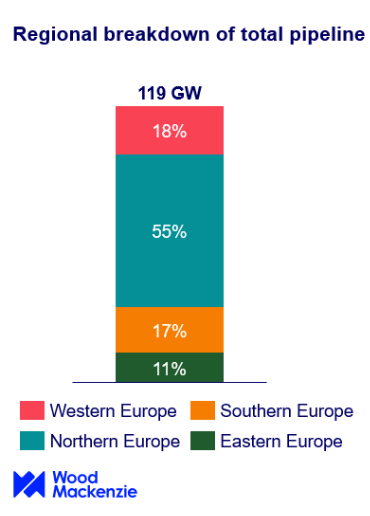

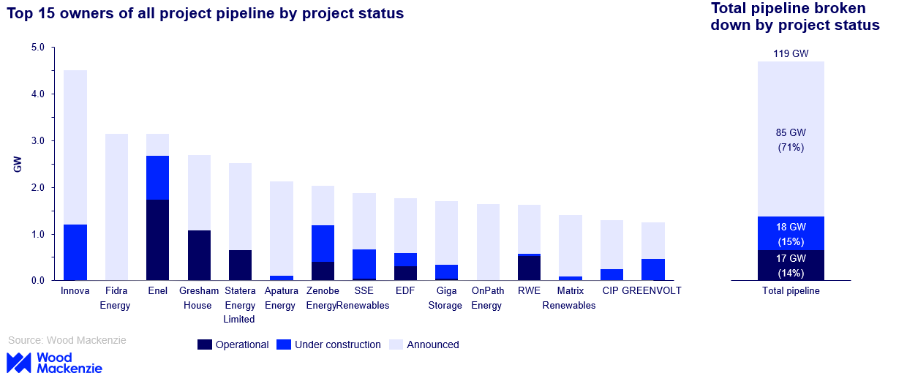

According to our findings, the top 15 asset owners of operational projects own over 40% of the pipeline, with Enel taking over the lead from Gresham House. This is significant as Enel is the first utility to hold this position, marking a clear shift in market dynamics.

Enel now hosts over 1.7GW of operational capacity, with an average duration of 4 hours, compared to Gresham House’s roughly 1.1GW with an average 2-hour duration This movement signals a market in which access to capital is increasingly constrained and reserved for the biggest players. Notably, Enel’s portfolio is concentrated entirely in Southern Europe, a shift from the UK-heavy portfolios that have dominated in previous years. This reflects how Italy’s capacity market and MACSE auctions are reshaping the competitive landscape.

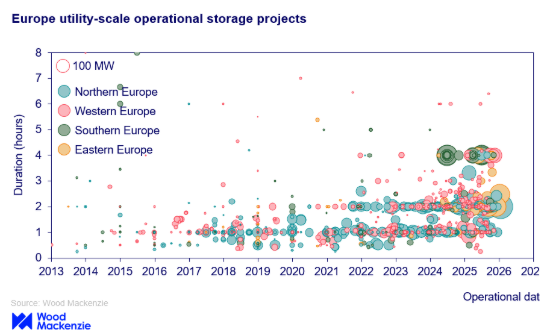

Regional competition is intensifying across European regions with varying maturity levels. Northern Europe is on lead owing to the UK maintaining its dominance with 7GW operational capacity and the most developed revenue opportunities for battery storage.

Western Europe success lies in Germany’s strong energy storage pipeline, supported by policy frameworks and merchant revenue potential.

Southern Europe’s growth is concentrated in Italy and Spain, where government-led auctions are driving utility and renewables developers into storage, though permitting challenges and declining capture prices threaten to slow progress.

Meanwhile, Poland, Bulgaria, and Romania are emerging as Eastern Europe’s competitive hotspots, representing over 80% of the Eastern Europe pipeline despite limited operational activity, a clear sign of early-stage market formation.

Project owners and long-term pipeline

When we look at the total project pipeline rather than just operational assets, we increasingly see that many companies can develop projects, but few can actually finance and deliver them at scale.

Behind several major storage players stand deep-pocketed financial backers. Zenobe is backed by KKR Infrastructure Fund, Statera by EQT Infrastructure VI, and Fidra Energy by EIG’s Sandbrook Climate Infrastructure Fund. Through backing from institutional capital and contracted revenues, leading storage developers can secure debt, absorb risk, and deliver projects at scale, a clear shift from the start-up phase of batteries in Europe that have been more dependent on government subsidies.

The market entry of Fidra Energy highlights this new dynamic. Despite only entering the market in 2024, Fidra immediately announced Europe’s largest battery project at 1,450 MW in the UK. These are gigawatt-scale portfolios that reflect the new competitive reality where capital depth matters as much as development expertise.

In future, Europe’s battery market relationships and capital matter more than before

As Europe’s storage market continues to mature, several questions will continue to shape the competitive landscape. Will mid-tier developers survive as financing becomes harder to access? Can utilities maintain their momentum against specialised IPPs in merchant-heavy markets? Which of the emerging Eastern and Southern European markets will deliver on their pipeline promises with grid bottlenecks becoming more of a roadblock?

The era of small, independent storage developers seems to be giving way to a market dominated by players with strong financial backing. With over 70% of the current European pipeline still in early-stage development, the ability to move projects from announcement to operation will increasingly separate market leaders from the rest. Though what will happen next remains to be seen.

About the author

Cecilie Kristiansen is research associate Energy Storage EMEA for Wood Mackenzie, who helped work on the European Energy Storage Competitive Landscape 2025. The report provides country-by-country leadership maps, regional trends, developer and owner rankings, company type breakdowns, co-location reviews, and forward-looking insights built on the underlying database. To learn more about the findings or access the dataset, reach out to the Wood Mackenzie team.

Energy-Storage.news publisher Solar Media is hosting the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 at the InterContinental London – The O2. ESN Premium subscribers can get exclusive discounts on ticket prices. See the official website for more details, including agenda and speaker lists.