Support CleanTechnica’s work through a Substack subscription or on Stripe.

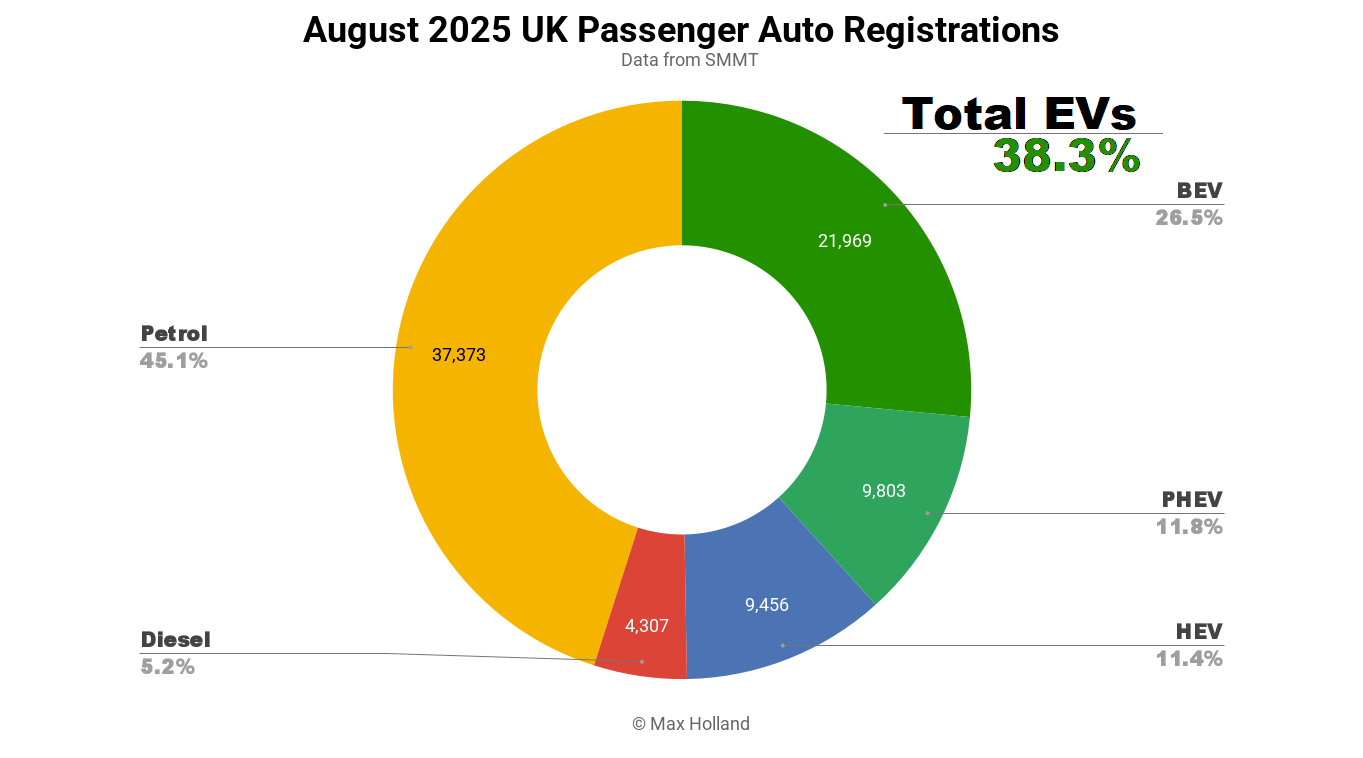

August’s auto market saw plugin EVs at 38.3% share in the UK, up from 29.4% year on year. BEVs grew volume 15% YoY, and PHEVs grew 69%. Overall auto volume was 82,908 units, down some 2% YoY. The UK’s leading BEV brand was Tesla, with a 15% share of the BEV market.

August’s auto market saw combined plugin EVs at 38.3% share in the UK, with full electrics (BEVs) taking 26.5% and plugin hybrids (PHEVs) taking 11.8%. These compare with August 2024 shares of 29.4% combined, 22.6% BEV, and 6.8% PHEV.

August is a seasonally slow month for autos in the UK, with consumers holding back purchases ahead of the “new” September license plate (because a shiny new car is status item for many). So whilst sales volumes of EVs were not impressive in absolute terms, their market share again reached new ground (excluding a couple of December peaks).

PHEVs, most of which are now capable of over 50 miles electric range, grew 69.4% in YoY volume, and have retaken the lead over HEVs for the first time since 2020. Combustion-only powertrains (combined) are still hovering just above 50%, but will slip below that in the coming months.

Last month we saw that the UK government’s revival of a BEV incentive scheme was introduced in a less-than-efficient manner, with the incentive announced before any models were confirmed to be eligible, leading to a cancellation in orders and a hold back in sales. By now, several models – all from European legacy auto companies – have been approved for the lower “Band 2” grant (£1,500). Only two models, the Ford Puma and Ford Torneo Transit, have so far been approved for the full “Band 1” grant (£3,750).

The assessment process is supposed to be based on low carbon production and supply chains, with 70% of the weighting given to the battery production. The batteries for these two Ford models are supplied by SK On from South Korea (likely from their Seosan and Pohang factories), and are assembled into packs in Ford Otosan’s plant in Craiova, Romania.

It’s not clear why these SK On cells are assessed to have a significantly lower carbon footprint than cells from other suppliers, given that South Korea’s grid is very coal-power heavy. Apparently the International Energy Agency’s 2022 carbon intensity data is used by the UK government to assess this. Meanwhile, most BEV models from Korean manufacturers are not eligible for the grant, raising further questions. The government has published no specific information on how a given model has been assessed and scored in practice, other than the general outlines of the scheme.

Despite the lack of clarity on those aspects, it is the case that the Ford corporation has relatively strongly (compared to peers) committed to “Science Based Targets” for short and medium term carbon-reduction goals (see SBTi, supported by the UN and other big institutions). These SBTi targets are used by the UK government as a proxy for measuring a company’s zero-carbon ambition, which plays a part in the grant eligibility assessment.

You can see the slowly growing list of models eligible for the new UK grant, on the government website. One of the positive aspects of the new scheme is that the base model price must start below £37,000 for a vehicle to be eligible. This of course prevents funds being wasted on premium models which are already price competitive with ICE peers, and need no support.

Targeting these lower priced vehicles also means the fixed-sum grant forms a larger portion of the vehicle price, and thus is a bigger incentive on purchasing behaviour. This is especially the case for the new generation of affordable cars like the Renault 5, Citroen e-C3, and Vauxhall Frontera (all of which qualify for the Band 2 grant). Unfortunately the Dacia Spring, Leapmotor T03, and BYD Dolphin Surf are unlikely to qualify for the grant, which is not a coincidence in relation to how the assessment has been designed.

Brands and models which are not eligible for the government grants are, however, trying to remain competitive by price reductions. This is something that the Chinese brands, with their low costs of production can likely accommodate, but that Korean, Japanese, and perhaps other brands, may find eats into their thinner margins.

Best-Selling BEV Brands

Tesla again took the largest share of the BEV market in August, at 14.8%. In second place was Volkswagen brand with 9.0%, followed by Ford, with 8.0%.

There were a few modest movements in the top 20 brands compared to July, mainly a result of most UK autos being (batch) imports, compounded by the RHD market being accommodated via batch production.

Whilst we don’t have fully accurate data on individual models (with many DVLA registrations listed as “unknown” models), we can pencil out some rough trends. The Omoda E5 SUV remained popular and maintained August volume (457 units) close to its July figures (477 units), despite August being a much lower volume month for overall autos. This relative outperformance resulted in the E5 climbing from around 17th spot in July, to 5th spot in August.

Due to being a seasonally slow month, it’s rare for new models to launch in the UK in August, but September will likely see more debutants. As an example, the new Mercedes CLA saw customer deliveries in other European markets in August, but was still at sample unit volumes in the UK. This appears to have changed in early September, so expect next month’s report to record the CLA delivering hundreds of units to the UK, just in time for the “new license plate” craze which accompanies the September auto market.

A new model which did make its UK debut in August was the Vauxhall (Opel) Frontera, with around 130+ units. The Frontera is late to the UK, having launched in Germany 11 months ago, and in other markets (e.g. Norway) earlier this year. However, it is a good value BEV, giving C-segment space (4,385 mm) for B-segment pricing – starting from £23,985 MSRP. If you shop around, you can find it from £19,995, for the entry 44 kWh version (186 miles WLTP). The 54 kWh “extended range” variant (253 miles WLTP) has less generous discounts, and can currently be found from £26,999.

Another August almost-debutant was the Isuzu D-Max EV, with just a single unit registered (likely for testing ahead of commercial launch in early 2026). The combustion version of this midsized pickup truck has been a rock-solid choice for rural workers in the UK (and Europe) for decades, and is finally being joined by a BEV version.

The D-Max’s EV powertrain specs are nothing revolutionary, but the main goal for Isuzu was to maintain all the rugged capability (towing, payload, 4WD) of the ICE version, rather than marketing this as a highway cruiser. The towing capacity is 3.5 tons, and the payload is 1 ton, and the power and torque are slightly above that of the ICE variants. The range is modest from the 66.9 kWh battery, at 163 miles WLTP (with 1 hour DC charging). This will likely be enough, however, for the rural duty the D-Max is usually put through. The major barrier will instead be the price point. Whereas an equivalent diesel costs from around £37,000 ex. VAT, the BEV variant will cost from £60,000 ex. VAT.

These two were the only debutants in August, but expect several more to arrive in September. Because August is a slow month, there’s not much news on progress in the small-and-affordable segments (Renault 5, Hyundai Inster etc), but we can expect decent volumes, and perhaps new entrants to the category, during the September rush.

Let’s now check up on the longer-term sales rankings:

Tesla overtook Volkswagen with a strong lead in the brand ranking, with 12% share of the BEV market over the past three months, an improvement from 7.8% in the prior period (March to May). Volkswagen meanwhile dipped from 9.4% to 8.5%.

Ford climbed from 5.8% share to 7.3% and was up two spots to third, pushing down both BMW and Audi, to 4th and 5th spots respectively.

Most other ranking changes were more minor, but it’s notable that both of Stellantis’ volume brands, Peugeot and Vauxhall, significantly cut their volumes, and tumbled in ranking, compared to the prior period. Some overall fall in volume is expected, on average, because the prior period included March – by far the largest volume month of the year.

However, while overall BEV volume was down 19.8%, Stellantis’s volume was down by almost 50% in Peugeot’s case (down to 3582 units), and by over two thirds in Vauxhall’s case (down to 1793 units). Summed across its all brands, Stellantis dropped volume by 47% to 8305 units, ganing just 8.4% of the BEV market. Is Stellantis planning to pay large ZEV Mandate fines by the end of this year? Or will it make a volume push (perhaps via new models) in the final months? Let us know in the comments

Outlook

Year to date, BEV volume is now 276,635 units, decently up by 19.5% from this point last year. PHEVs have increased more still, by some 34% YoY, to 134,331 units. The ZEV mandate is definitely working, and the new incentives should keep the legacy automakers from their incessant whining about how “difficult” the transition is.

The UK’s macroeconomy is unspectacular, at 1.2% YoY GDP growth, as of latest Q2 data. Headline inflation increased to 3.8% in July, from 3.6% in June. BOE interest rates dropped in early August to 4.0%, from 4.25% prior. Manufacturing PMI dropped to 47 points in August, from 48 in July.

What’s next for the UK’s EV transition? What new models or categories are you hoping to see in the coming months. Which recent models or brands will prove popular and quickly climb the ranks? Please share your thoughts and perspectives in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy