Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 7th February 2025, 08:29 am

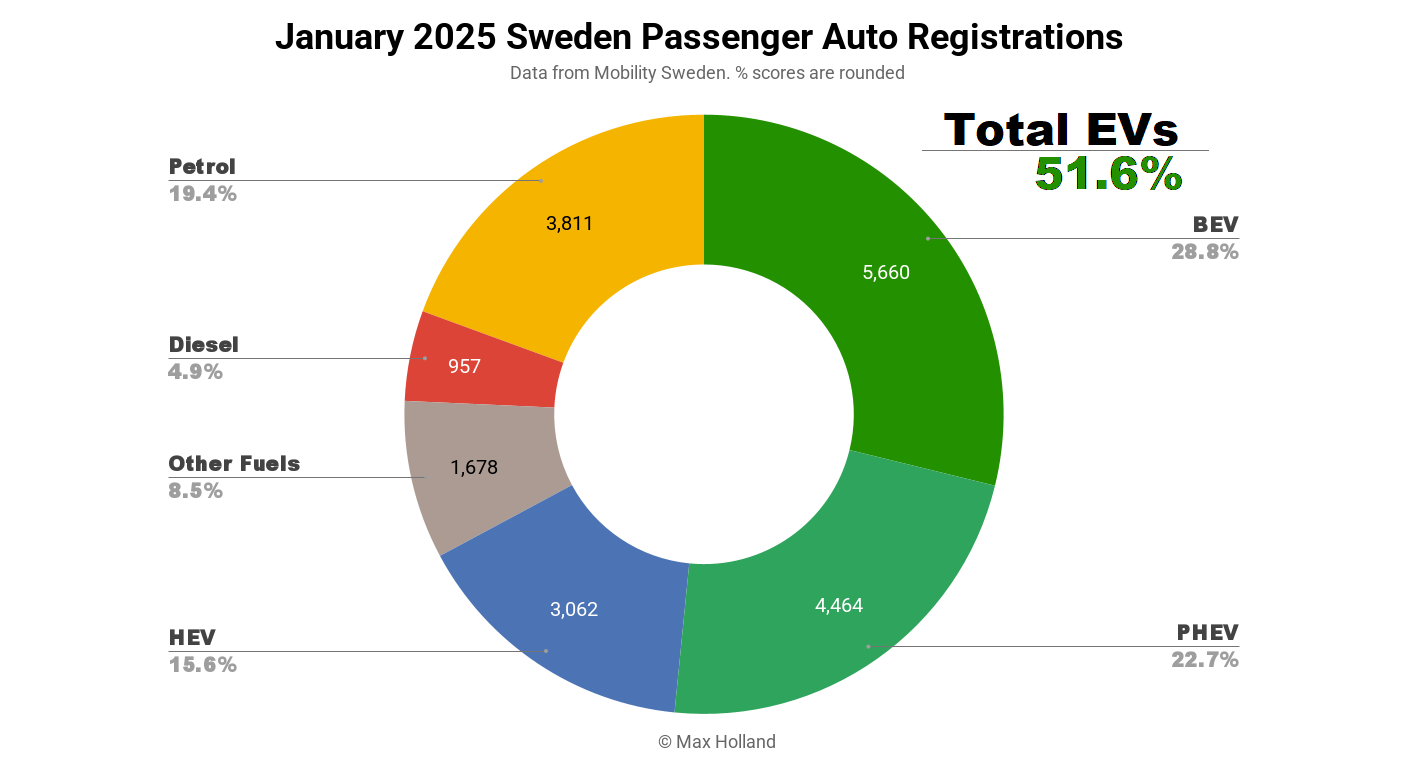

January’s auto sales saw plugin EVs at 51.6% share in Sweden, down slightly YoY from 52.5% in January 2024. BEV share was fractionally up YoY, while PHEV share was slightly down. Overall auto volume was 19,632 units, up some 14% YoY. The Volkswagen ID.7 was the best selling BEV.

January’s sales totals showed combined plugin EVs at 51.6% share in Sweden, with full electrics (BEVs) at 28.8% and plugin hybrids (PHEVs) at 22.7%. These figures compare YoY against 52.5% combined, 28.6% BEV and 23.8% PHEV.

There was a small anomaly in the January market, with an unusual surge for “other fuels” – at 1,678 units – over 5x their recent monthly average. These are almost all vehicles classified at “other” only because they are “able to” run on ethanol (even though they may in practice be mostly run on regular gasoline / petrol / benzine). Their January surge was a “last chance” pull-forward ahead of a Swedish regulation change from February 1st which – due to the reality of their mostly being run on gasoline – now puts a heavier tax burden on them. The new rules now tax them in-line with gasoline-only vehicles, closing a former loophole. Expect a severe hangover for this category in February and March, and general weakness going forward.

Plugless hybrids (HEV and MHEVs) grew volume by 67% YoY, their highest monthly number since 2020. These are mainly a quick-and-easy stopgap for legacy auto makers towards meeting tightening emissions rules (relative to ICE-only cars). Since these are effectively substituting sales of ICE-only cars, the latter declined in volume to near-record lows. Even so, together, the combined sum of HEV and ICE-only cars grew volume by 4.5%, underperforming the overall market’s 14% growth. Thus their combined share fell YoY from 43.7% to 39.9%.

For plugins, despite their fractional fall in market share, sales volume actually grew decently YoY, from 9,006 units to 10,124 units. The slight drop in plugin share comes simply from not increasing their volume as much as the competing ethanol powertrain vehicles, in their anomalous pull-forward, discussed above.

With the Europe-wide tighter vehicle emission rules in 2025, we can expect BEVs to grow overall this year in Sweden, as well as in other regional markets.

Best Selling BEVs

The Volkswagen ID.7 was Sweden’s best selling BEV in January, its first time in the top spot, with 588 units.

Second place went to the Volkswagen ID.4 with 396 units, and third went to the Tesla Model Y, with 290 units.

With mostly familiar faces, the notable performances came in the form of decent climbs by relative newcomers, the Kia EV3, and the Cupra Tavascan. The Kia EV3, which debuted in November, keeps steadily ramping, and has now reached 7th place, a great result, and now the highest rank of any Korean BEV.

The Cupra Tavascan debuted in August and has also steadily ramped its Swedish volumes since then, now at 170 units, and 11th place. This is a good result for Cupra, though the Tavascan’s usurped sibling, the Born, may not be so happy, now outside the top 20 after previously ranking around 10th. The SUV format of the Cupra Tavascan is (understandably) much more popular in Sweden and the Nordic countries.

January saw two debuts on the Swedish market. The new Opel Grandland X arrived with 29 units. This is a mid-sized (4650 mm) SUV, with a length somewhere in between the Peugeot E-3008 and E-5008 with which it shares its platform. It is priced from 3,399 SEK (300€) per month for leasing, for the entry 73 kWh (usable) version. I can’t find an MSRP price on Opel’s website or price list (leasing seems to be the priority), please chime in below if you have this.

We’ve detailed the specs of the new Renault 5 elsewhere, and it saw a modest 11 unit Swedish debut in January. It may not be the most popular format of vehicle in Sweden, but for those who are looking for a small hatchback (from MSRP 349,900 SEK or €31,000), the Renault may appeal. Let’s see how it gets on.

December’s debutant, the Audi A6 e-tron, climbed to a decent 36 units in January (and already 35th spot). We will track how close it might get to the top 20.

Now for the 3-month perspective:

Thanks to the end of 2024 push, the Tesla Model Y is still very dominant in Sweden. The refreshed model will start local deliveries in March, so January and February are inevitably going to be somewhat slow months for Tesla’s best seller. Don’t be surprised to see the Model Y back on top by the end of Q2, however.

The biggest move in the top 20 chart came from the Kia EV3, which was almost absent 3 months ago (just 1 unit delivered), but has shot up to 569 units over the past 3 months, and taken 12th spot. We can expect it to keep climbing from here. Recall that its much older sibling, the Kia Niro, was a top 5 favourite in Sweden for several years. If this family’s pedigree is anything to go by, expect to see the EV3 inside the top 10 soon.

Further back, as you may have guessed, the Cupra Tavascan is still climbing, having reached 19th based on the trailing 3 month volume. The Tavascan could potentially climb above 15th in the coming months, let’s watch out for that.

Outlook

Whilst the 14% growth in the auto market is a decent sign for the Swedish economy, around half of that growth is a one-off bump from the ethanol vehicles’ pull-forward, discussed above. The broader GDP growth was up 1.1% YoY in Q4 2024, the best result in two years. Inflation is now low at 1%, and interest rates have reduced to 2.25% (helping new car financing). Manufacturing PMI remained somewhat positive in January, at 52.9 points, from 52.4 in December.

As mentioned earlier, the Europe-wide emissions tightening rules in 2025 should translate to steady growth in the BEV market this year, after notable backsliding in 2024. This growth may not be visible until the second half of the year, and especially the final quarter.

What are your thoughts on Sweden’s auto market and the EV transition? Which models will do well this year? Please jump into the comments section below and share your perspective.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy