Support CleanTechnica’s work through a Substack subscription or on Stripe.

The Trump administration’s stop-work order on Ørsted’s Revolution Wind project has already become a defining event for investors and developers in the United States energy sector. The project was nearly complete, with billions already invested in turbines, monopiles, offshore cables, port infrastructure, and labor. Every required federal and state permit had been secured. Supply chains had been scaled up. Contracts had been signed with utilities to deliver electricity. Yet with a single vague justification of “national security,” the Bureau of Ocean Energy Management froze work on the project and threw its financial viability into doubt. Ørsted and its partner Skyborn are now in court, arguing that the order has no statutory basis and violates due process. No matter what the legal outcome, the larger message is unmistakable. In today’s United States, under a populist conservative administration, even a project that is legally permitted, financed, and nearly finished can be stopped cold.

This case does not exist in isolation. It fits a pattern we have been watching take shape across conservative jurisdictions for years. Ontario is one of the starkest examples. In 2018, Doug Ford’s government canceled 758 renewable energy contracts in one stroke, including the White Pines wind farm in Prince Edward County that was already standing with turbines erected and grid connections in place. The government passed legislation to retroactively eliminate recourse through the courts, which meant developers could not even sue for damages. Millions in sunk capital evaporated overnight. Turbines that had taken years to build were torn down. The economic logic was shattered, but more importantly the political signal was unmistakable: in Ontario, a signed contract was no longer a guarantee of execution if the governing party disapproved of the technology.

Texas came close to repeating this pattern with Senate Bill 715. The proposal would have forced existing wind and solar projects to provide dispatchable backup power or face penalties, even though they had been financed and built under different rules. This was an attempt to apply new obligations retroactively, undermining the foundational expectation of contract law that agreements and regulations at the time of signing remain stable. SB 715 did not make it to a full hearing in the Texas House and was never brought to a vote before the 140-day biennial session closed. That is an important nuance. The legislation never became law, but the fact that it advanced as far as it did was enough to inject risk into the market. Investors saw plainly that political hostility to renewables was strong enough to threaten projects that were already in operation. In capital markets, the threat alone changes the calculus.

Alberta provides a more recent case. In 2023, the provincial government imposed a seven-month moratorium on new renewable project approvals, halting hundreds of developments in the pipeline. Developers had already spent heavily on site studies, environmental assessments, and engineering. Investors had already earmarked funds. When the moratorium was lifted, it was replaced with restrictive new siting rules and conditions that most observers interpreted as designed to prevent significant new projects from moving forward. For investors, Alberta’s message was similar to Ontario’s and Texas’s. Capital placed at risk in renewables could be frozen or wasted if the government chose to intervene for ideological reasons.

Across all of these cases, from Ontario’s mass cancellations to Alberta’s moratorium to Texas’s near miss and now the United States federal government’s stop-work order, the same features recur. Populist conservative governments see political advantage in opposing renewables. They take actions that affect projects after contracts are signed and financing is committed. They justify the interventions with broad, sometimes nebulous rationales, ranging from consumer relief to grid reliability to national security. They leave developers, financiers, and supply chains holding the costs. And they create an enduring chill on investment that stretches far beyond their borders.

What makes these cases particularly alarming is that the concern goes beyond the renewable sector. The principle at stake is not limited to clean energy. If governments can stop a nearly completed offshore wind farm on ideological grounds, then no class of contract is safe from political interference. The lesson that international investors will draw is not just that wind farms are at risk under populist administrations. The lesson is that any contract that collides with the ruling ideology could be voided or frozen. Infrastructure projects, manufacturing plants, pharmaceutical supply agreements, or technology deployments could all be subject to the same instability. If the political will exists, the legal framework can be bent to justify it.

Witness the ICE raid on Hyundai and LG’s Georgia battery plant as a case study in how political ideology untethered from pragmatism can destabilize investment. Multibillion-dollar factories are planned on timelines that span decades, requiring confidence in predictable regulatory and immigration frameworks. When hundreds of South Korean specialists brought in to install and commission the very equipment America desperately needs for its energy transition are suddenly swept up in a show of force, the message to global investors is clear: the United States cannot be relied on to provide a stable operating environment. This is not about enforcing immigration law; it is about weaponizing bureaucracy for ideological signaling, and the chilling effect on foreign direct investment will be profound.

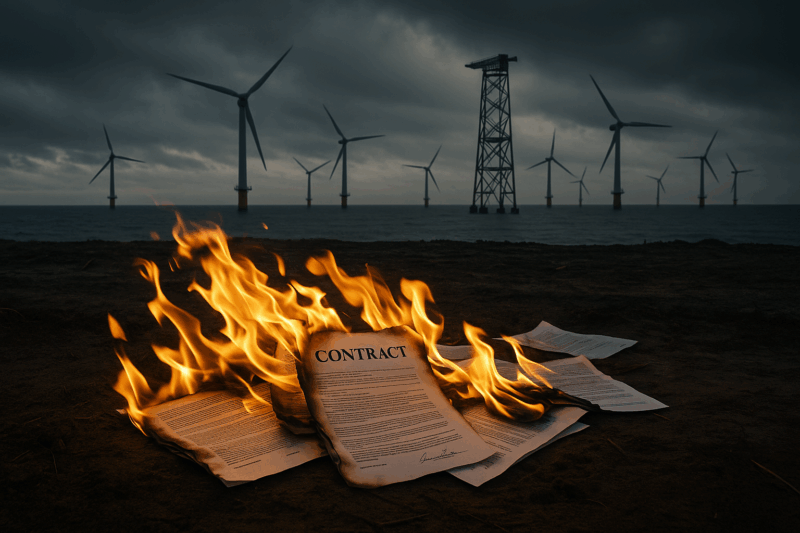

This is the economic version of book burning. In past centuries, authoritarian regimes burned books to control which ideas could circulate. Today, populist administrations that tear up contracts are in effect burning capital. They are destroying not paper and ink, but the trust that enables billions of dollars to be mobilized into productive infrastructure. When a wind farm is dismantled in Ontario, or a project is frozen in Alberta, or a nearly complete offshore facility is shut down in the United States, the act is not just about renewables. It is about the state declaring that the rules of the game are subject to ideology, not to law.

The consequences of this are profound. Financing costs climb because lenders demand higher returns to compensate for political risk. Some investors exit markets entirely. Supply chains that require long-term stability wither. Skilled workers migrate to jurisdictions where their projects are not subject to sudden ideological reversals. The overall pace of infrastructure deployment slows. Consumers end up paying more for less reliable systems. The ripple effects move far beyond the immediate jurisdiction. Ontario’s retroactive cancellations are still cited internationally as a case study in political risk. Alberta’s moratorium has already become a standard warning in investment analyses. Texas’s SB 715 is regularly noted as evidence of political hostility that could resurface in future sessions. The Ørsted case will now be referenced whenever global financiers discuss the stability of United States offshore wind.

The message to capital markets could not be clearer. Under populist conservative administrations, contracts cannot be assumed to hold if they clash with political ideology. What begins with renewables may not end there. A government willing to intervene retroactively against wind or solar is demonstrating its willingness to override contracts wherever it sees fit. That is not just an attack on clean energy. It is an attack on the foundational principle that contracts are binding, predictable, and enforceable. Once that principle erodes, the economic costs multiply.

The energy transition depends on the steady mobilization of private capital into projects with lifespans of decades. Without confidence that contracts will be honored regardless of politics, that capital dries up or becomes vastly more expensive. The same holds true for other sectors that require long-term investment. The burning of contracts, like the burning of books, undermines trust, spreads fear, and signals that ideology is more important than the future. The Ørsted case, like Ontario’s cancellations, Alberta’s moratorium, and Texas’s threatened retroactive mandates, shows how quickly decades of progress can be undone when governments put politics ahead of law. That should worry anyone who cares not just about clean energy, but about the integrity of the entire economic system.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy