Support CleanTechnica’s work through a Substack subscription or on Stripe.

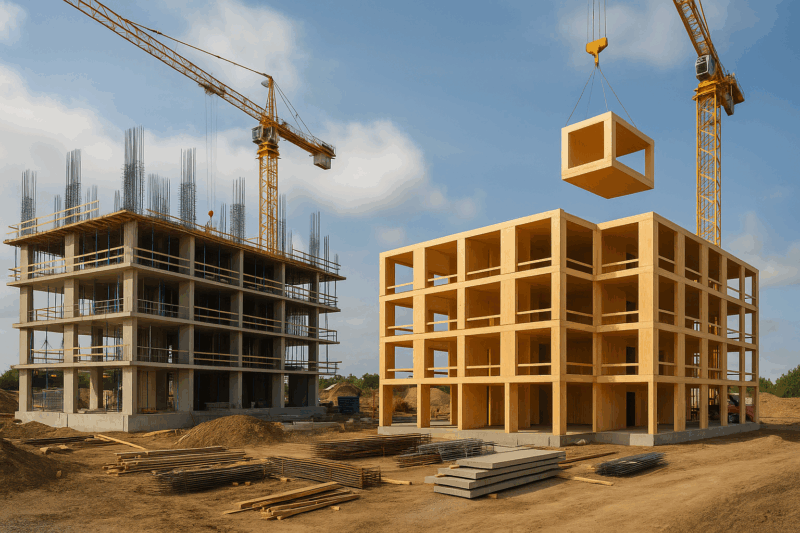

Cross laminated timber is often presented as a housing solution, a way to build faster and more affordably while reducing the carbon locked into buildings. That is true, but it is also part of a larger story about the heavy materials industries. Every time a cubic meter of cross laminated timber (CLT) replaces concrete, the demand for cement and the demand for rebar decline. Over decades, those substitutions add up. What looks like a small shift in construction methods at the project level becomes a driver of global demand curves for both cement and steel. By bending those curves downward, CLT helps make decarbonization in the heaviest industries more realistic.

The first three articles in this series established the foundation. The opening piece showed that CLT and modular construction are Canada’s fastest lever to address the housing shortage and embodied emissions at the same time. The second article explored Mark Carney’s Build Canada Homes initiative and argued that government must act as an anchor customer for CLT factories, turning policy into real square footage. The third article laid out the mass timber playbook, describing the need to integrate sawmills, bioenergy, adhesives, and logistics into a coherent value chain. This article builds on that foundation by looking outward, asking how CLT shapes the long term trajectories of cement and steel demand.

For years, projections of cement and steel demand have assumed almost linear growth in line with GDP and urbanization. These models often point to mid-century peaks and flat demand well into the back half of the century. My assessment is different. The Chinese infrastructure and building boom that drove global demand in the last two decades has peaked. Advanced economies are shifting from expansion to maintenance. Efficiency gains are real and accelerating. Substitution pressures from timber, lightweight composites, and smarter design are starting to bite. Taken together, the result is that global demand for both cement and steel will peak earlier, flatten more quickly, and then decline gradually for the rest of the century.

Cement is the clearest example. In mid-rise residential and parts of the commercial sector, CLT is already displacing concrete slabs and cores. Codes are evolving to allow taller timber structures and procurement policies are starting to recognize embodied carbon. Supplementary cementitious materials are being blended into mixes around the world, reducing the clinker ratio in every cubic meter of concrete.

In my projection curves, cement demand does not climb steadily to 2100. It peaks in the 2020s, flattens in the 2030s, and then declines to about a third of today’s levels by the end of the century. The drivers are substitution by mass timber where it makes sense, efficiency in design that uses less material, and caps on embodied carbon that reward lower carbon alternatives. The cuts bite hardest in residential and office buildings, where modular CLT is becoming a mainstream option. Infrastructure like highways and dams will continue to need cement, but the aggregate volumes will not offset the reductions in the building sector.

In its long-term forecast, the World Cement Association agrees that global cement demand, particularly for clinker, will peak well before mid-century and then decline significantly. The white paper suggests that demand could fall from around 4.2 billion tons in 2020 to approximately 3.0 billion tons by 2050. By mid-century, cement demand may sit at just half of today’s level, driven by slower growth in China, expanded use of substitutes and design efficiencies, and the rise of low-carbon alternatives. That outlook aligns closely with my modeling. Where most forecasts expect continual growth, WCA sees a future reshaped by material substitution and efficiency, exactly what mass timber brings to the table.

As a side note, this is one of the few cases where my projections of demand decline in major industries is publicly agreed on by the industry itself. There are economic reasons for a public projection of growth even if the industry knows it’s facing decline or at minimum much slower growth. Look at oil and gas, maritime shipping, and aviation for prime examples, as well as the absurd projections of hydrogen demand growth.

Steel is tied closely to cement because so much steel goes into rebar and structural frameworks for concrete buildings. As concrete declines, so does the need for rebar. My projections show global steel demand bending downward in parallel with cement. This does not mean steel vanishes. Infrastructure, vehicles, and machinery will continue to require it, but the rebar segment will shrink steadily. The opportunity that comes with this shift is significant. A flatter and declining steel demand curve makes it possible for electric arc furnaces powered by clean electricity to dominate global production. That transition depends on scrap flows being sufficient to cover a larger share of demand.

With lower total demand, the scrap available is enough to feed more of the system. In effect, the substitution of CLT for concrete not only cuts emissions directly but also makes the steel industry’s decarbonization problem easier by reducing volumes and aligning with scrap based pathways.

The guiding policy that emerges from this analysis is clear. We should prioritize timber in buildings where it performs as well or better than concrete and steel, and codes and financing should favor low embodied carbon materials. Procurement should credit the biogenic storage in timber, recognizing the carbon locked away in panels for decades. Embodied carbon caps in building codes can nudge developers and designers toward materials that score better on life cycle analysis. These are not radical steps. They are practical tools that reward better choices and accelerate substitution.

The actions are equally concrete. Timber should become the default for multi-unit residential buildings and mid-rise offices. Hybrid designs should replace podiums, stairwells, and cores with timber where engineering supports it. Cement mixes should be pushed toward maximum supplementary content, cutting clinker volumes wherever possible. Steel producers should double down on electric arc furnace pathways, aligning recycling infrastructure and scrap collection with projected demand. Taken together, these steps lock in the displacement of cement and steel in the building sector and make the heavy industry decarbonization challenge manageable.

Risks remain. If codes evolve too slowly, substitution will lag. If insurance markets resist, adoption will be slower. Incumbent industries will continue to defend their markets. Lumber supply volatility and land management controversies can undermine the case for mass timber if not handled responsibly. At the same time, the enablers are strong. CLT costs are coming down with scale. Government procurement can lead by example. Investors are focusing on embodied carbon as part of ESG mandates. Export markets, particularly in the United States and Europe, are opening quickly to mass timber solutions.

The conclusion is that CLT is one of the sharpest knives we have to cut into global cement and steel demand, reducing the challenges of dealing with emissions from those hard-to-abate sectors. It is not the only lever, but it is a powerful one that compounds over decades. By displacing concrete and the rebar inside it, CLT bends both curves downward, turning what looked like an impossible decarbonization climb for heavy industry into a slope that can be managed.

My projections for cement and steel through 2100 reflect this reality. Cement peaks soon, declines steadily, and ends the century at about a third of today’s levels. Steel flattens, declines, and transitions to an electric arc furnace dominant industry powered by clean electricity and abundant scrap. These curves are not just numbers. They are pathways to aligning housing, economy, and climate in a way that makes the future less daunting and more achievable.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy