While it is not yet feasible to create a supply chain of battery materials solely from recycled products, the inclusion of recycled materials in the US supply chain and the theoretical ability to do so would be of great benefit to US cell manufacturers and developers.

Writing for Energy-Storage.news, Iola Hughes, head of research at Rho Motion said of the US storage market: “Many of these gigafactories [spurred by the Inflation Reduction Act] are still in the planning or early construction phases, with expected production start dates extending into the late 2020s.”

China already has a robust battery supply chain and battery recycling infrastructure. But, as Hughes explains, and as seen in recent days, US president Donald Trump could add complexities to this dynamic:

“The election of Donald Trump as the 47th President of the United States raises some questions about supply, given the heavy reliance on Chinese cells and the potential for higher tariffs. An increase in tariffs on Chinese batteries for BESS— currently set to take effect in 2026— would strain US integrators and developers, especially in the near term, where few domestic alternatives exist.”

Li-Cycle noted a significant gap between post-processing recycling capacity and the expected number of recyclable batteries that will be available in the next five years in the US.

“Other countries, such as China, have more mature recycling infrastructure, but they also have a correspondingly more mature battery manufacturing market. As the U.S. domestic lithium-ion battery supply chain continues to grow, we would expect recycling to also grow in parallel.”

Li-Cycle said it is well-positioned to help bridge this gap in post-processing recycling capacity with the Rochester Hub project. The company recently finalised a loan of US$475 million with the Department of Energy’s (DOE) Loan Programs Office (LPO), which will enable it to resume construction on the project located in Rochester, New York.

BESS growing in importance for recyclers

Li-Cycle has also seen an increase in battery energy storage system (BESS) materials in its feedstock. The company largely recycles electric vehicle (EV) batteries, but as former Li-Cycle CCO Kunal Phalpher told Energy-Storage.news in June 2021, “Overall, we see energy storage as becoming a large market for end-of-life batteries and recycling will help ensure the sustainability of the industry from both an economical and environmental perspective.”

BESS projects are still relatively new, with many developers claiming around 10-15 years of battery lifespan. As these projects begin to reach end-of-life in succession or even become damaged over time, recycling centres like Li-Cycle will start to see a change in the types of batteries being processed.

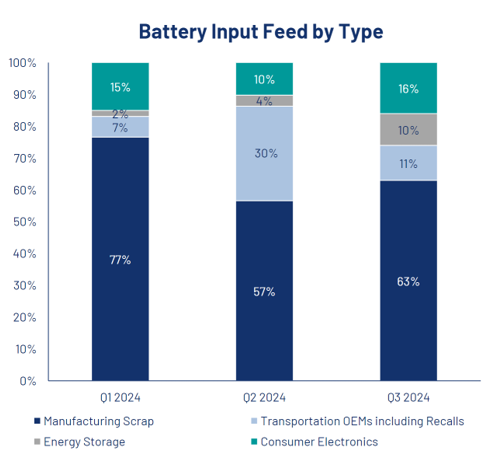

As shown in Li-Cycle’s Q3 2024 investor presentation, the amount of BESS material in the company’s feedstock more than tripled from Q1. The company says this material is largely from defective or damaged products rather than end-of-life batteries, but it does anticipate the mix changing over the coming years.

“Energy storage systems continue to be a part of the available batteries that require recycling, and we anticipate that by 2030 they will account for the third largest source of feedstock in North America.”

Company’s recycling technology

The company uses a two-phase process to recycle lithium-ion batteries. Items are first shredded, removing plastics and metals and leaving behind the shredded metal of the electrode material. The shredded metal then goes through a hydrometallurgy, wet chemistry process, removing the valuable materials.

Li-Cycle’s recycling process provides a sustainable alternative for obtaining materials such as cobalt, which is still widely used in cell chemistries like nickel manganese cobalt (NMC), and often comes with the higher environmental footprint of mining operations.