Support CleanTechnica’s work through a Substack subscription or on Stripe.

The publication of Kim and Macfarlane’s 2026 study on small modular reactors is a moment worth pausing over. Nuclear energy sits at the margins of most serious decarbonization pathways today, but SMRs have been marketed as the technology that could change that. They are advertised as cheaper, safer, faster to build, and easier to finance than traditional large reactors. The new study, published in Progress in Nuclear Energy, takes a sober look at those claims and finds them wanting. It does not dismiss nuclear power outright, but it asks hard questions that should matter to policymakers, investors, and utilities deciding whether to commit public money and grid space to SMRs.

The strength of the study lies in who wrote it. Philseo Kim is a researcher focused on nuclear economics and policy. Allison Macfarlane is a former chair of the U.S. Nuclear Regulatory Commission and one of the most credible voices on nuclear waste and governance. Together they bring both technical and policy lenses. Their prior work, including a 2022 analysis of SMR waste streams, already suggested that these reactors could produce more complex and larger volumes of waste than conventional nuclear plants. This paper extends that research into both costs and waste, and the picture that emerges is not encouraging.

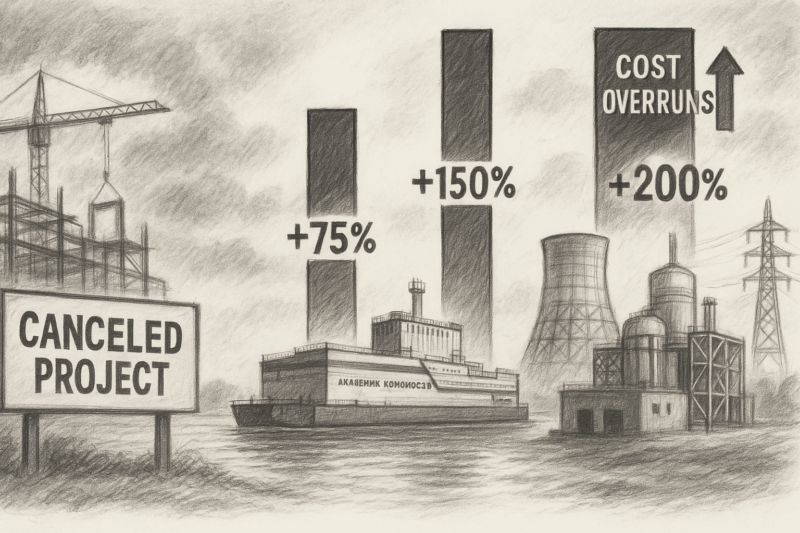

At the core of their economic analysis is the levelized cost of electricity, or LCOE. This metric aggregates capital, operating, and fuel costs over the life of a power plant. The authors reviewed estimates for four U.S. SMR designs, including light-water and advanced non-light-water concepts. They found huge uncertainty in the cost projections. Some industry estimates suggested competitive costs around $60–80 per MWh, but these assumed high-volume serial manufacturing that has never materialized in nuclear. More realistic estimates, and the few real-world projects we have seen in Russia, China, and the U.S., point toward costs well above $100 per MWh, in some cases multiples of that. The cancellation of NuScale’s flagship project after costs ballooned from $5.3 billion to $9.3 billion is a case in point. The fundamental problem is economies of scale. Smaller reactors mean higher costs per unit of output, and only massive replication could reverse that trend. No country is on track to build the hundreds of identical units required.

On waste, the findings are even starker. The study shows that SMRs could generate two to thirty times more spent fuel per unit of energy than today’s large reactors. Their smaller cores leak more neutrons, which activates surrounding steel and creates more long-lived radioactive material. Some designs produce waste streams that have never been handled before, such as irradiated graphite or chemically reactive salts. These would require new packaging, licensing, and repository designs. Over the long term, some SMR fuels are projected to be about 50 percent more radiotoxic than conventional spent fuel after 10,000 years. This is not the story of simplified waste management that vendors have been telling.

It is important to recognize what the study does and does not claim. It does not predict exact future costs down to the dollar. It does not assert that every SMR will inevitably fail. What it does is map the range of uncertainties and point out that most of the factors that could raise costs and increase waste are structural. Smaller reactors inherently lose the cost advantages of scale. More exotic designs bring more exotic waste. The best case scenarios depend on optimistic assumptions about mass manufacturing and learning curves, which nuclear construction has never delivered on. That makes SMRs a high-risk proposition in a world that needs low-cost, fast-to-deploy decarbonization tools.

Industry responses have been predictable. NuScale and Terrestrial Energy have disputed the waste findings, claiming the study used outdated or inaccurate assumptions. Advocates argue that modular construction and repetition will eventually drive costs down. Yet the actual evidence from early projects points in the other direction. Russia’s floating SMRs and China’s HTR-PM both came in several times over budget and have not been replicated. In North America and Europe, SMR projects remain on paper or in the very early stages, with commercial operation unlikely before the 2030s. The study’s authors are careful to acknowledge the lack of operating data, but they argue persuasively that independent analysis is essential precisely because vendors are not transparent about these issues.

This work aligns closely with my own long-standing assessment of SMRs. The economic logic has always been shaky. Nuclear scaled up in size over decades because larger units delivered lower costs per MWh. Reversing that logic without a revolutionary change in manufacturing economics has never made sense. The waste concerns add another layer. Nuclear waste is already an unsolved political and technical problem. Multiplying the volume and diversity of waste streams makes the task harder, not easier. SMRs do not solve nuclear’s fundamental challenges. They replicate them in smaller packages while adding new complications.

Globally, the picture is consistent. Russia and China have the only operating SMRs, both over budget and limited in scale. Argentina’s CAREM reactor is delayed. Canada, the UK, and the U.S. are investing in SMR designs, but none are near commercial readiness. Fuel supply for advanced designs is another bottleneck. Over 30 SMR concepts require high-assay low-enriched uranium, and only Russia currently produces it at scale. Waste repositories worldwide are designed for conventional spent fuel, not for the new waste forms SMRs would generate. The promises of SMRs as fast, modular, and globally deployable have not been borne out in practice.

As I was discussing with a global, multi-stakeholder research organization focused on what a real zero emissions economy will look like this morning, for what little nuclear generation we will end up with — maybe 5% of total energy because ideologues will build it — GW-scale 3rd generation reactors are just fine, assuming that all the other conditions of success are met.

The implication for system planning is clear. Decarbonization this decade depends on scaling technologies that are already cheap and fast to deploy: wind, solar, batteries, interconnectors, demand management. SMRs, if they succeed at all, will not arrive in meaningful numbers until the 2030s or 2040s. They may have niche roles, but they will not be a major wedge in global emissions reductions. Given their cost and waste risks, they should not crowd out higher-probability options for near-term deployment. Governments can continue to fund limited demonstrations, but public support should be conditional, milestone-based, and tied to transparent disclosure of waste and cost data.

The publication of Kim and Macfarlane’s study provides a clearer evidence base. It is a reminder that enthusiasm and marketing do not erase structural challenges in physics and economics. For policymakers and investors, the lesson is straightforward. Do not assume SMRs will be cheaper, faster, or cleaner than large reactors. Demand proof on cost, waste, and delivery before committing significant resources. In a world of limited capital and urgent climate deadlines, the prudent course is to double down on the technologies that are delivering now and keep nuclear in a narrow test lane with clear stop rules.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy