The revenue outcome aligns with broader analysis of NEM battery trading dynamics. In a recent contributed blog by OptiGrid for Energy-Storage.news, the organisation delved into battery trading performance and how metrics such as normalised revenue and percent of perfect (PoP) foresight can be used to assess value capture relative to ideal dispatch outcomes.

Battery storage systems that can hold charge into the most lucrative intervals, and dispatch at the right moment, tend to achieve higher normalised revenue and closer alignment to perfect foresight benchmarks. Achieving this performance increasingly depends on accurate forecasting and sophisticated optimisation, particularly during extended price events rather than short-lived spikes.

Meanwhile, independent energy consultant Allan O’Neil, a former analyst at EnergyAustralia, said the price event in South Australia produced the third-highest average daily spot price outcome for South Australia since the start of the NEM.

O’Neil observed that the aggregated operational battery storage fleet in the region has just under 1.5 hours of storage capacity, meaning that extended high-price intervals are always likely to challenge its ability to sustain output.

The fleet entered the 4-hour period of prices above AU$1,000/MWh with around 90% state of charge and rationed energy between 18:00 and 21:00.

O’Neil noted that while the fleet may not have captured optimal value from the earliest portion of the stored energy between 18:00 and 19:00, delaying discharge entirely could have resulted in even more extreme price outcomes earlier in the evening.

By shortly after 20:00, much of the fleet had depleted its available charge, allowing thermal generation to maintain elevated prices for much of the following hour and a half.

A previous heatwave in Australia highlighted operational stresses on BESS assets during extreme weather. In an interview with ESN Premium earlier this month, Javier Savolainen, market development manager at Wärtsilä, discussed how Australia’s battery storage fleet faces challenges during periods of sustained high temperatures, including thermal management constraints and the compounding effect of high demand on dispatch strategies.

Such conditions place additional emphasis on asset design, cooling systems and operational planning as storage becomes a more central component of grid operations.

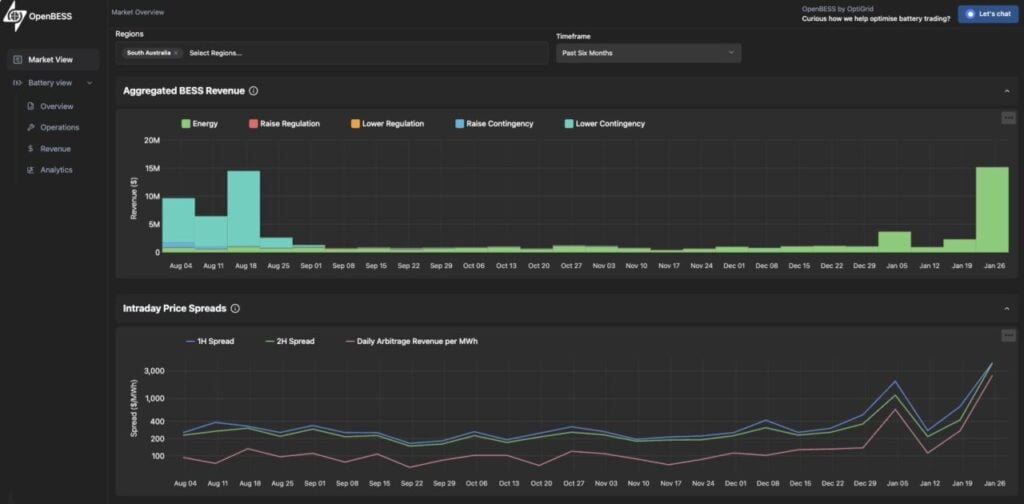

South Australia’s market conditions continue to provide a distinct testing ground for battery economics. The state led a surge in battery revenue during the first week of 2026, reflecting the combination of high renewable penetration, volatile pricing and increasing battery participation. These dynamics have reinforced the state’s role as an early indicator of how storage assets may perform as renewable shares rise across the NEM.

However, revenue opportunities during extreme price events are not always fully accessible to battery storage systems.

System security requirements can override market-based dispatch, as illustrated in previous incidents where AEMO directed thermal plant operations in South Australia to maintain grid stability. Such interventions showcase the ongoing tension between storage economics and reliability imperatives in a power system undergoing rapid transition.

The Australia Day heatwave reinforces a broader industry lesson: while batteries are increasingly effective at responding to price volatility, short-duration assets remain constrained during prolonged stress events.

Longer-duration storage technologies and evolving market frameworks may help address these limitations over time, something the state is already exploring. But, for now, South Australia’s experience offers a clear picture of both the growing value of battery storage in the NEM and the operational boundaries that continue to shape how that value is realised.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March. It features keynote speeches and panel discussions on topics such as the Capacity Investment Scheme, long-duration energy storage, and BESS revenue streams. ESN Premium subscribers receive an exclusive discount on ticket prices. To secure your tickets and learn more about the event, please visit the official website.