In my recent reassessment of global steel demand trajectories, particularly in light of declining cement consumption driven by a slowing Chinese construction sector, I’m revisiting several zero-carbon steel production pathways. One that stands out for its unique electrochemical elegance and considerable engineering complexity is molten oxide electrolysis (MOE). It’s an approach that could fundamentally transform steelmaking, but whose practical realities deserve careful consideration from a techno-economic viewpoint.

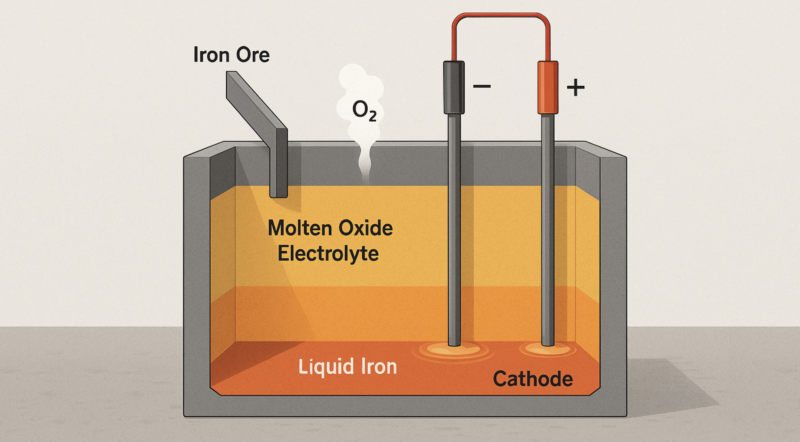

Molten oxide electrolysis is, at its core, electrochemical smelting. Instead of chemically reducing iron ore with carbon-based reductants like coal, coke, or natural gas, it directly reduces iron oxide to metallic iron using electrons provided through electrical current. In a molten electrolyte bath at roughly 1600°C, iron oxide — rusted iron — dissociates into molten iron and oxygen gas. The cathode reaction sees iron ions accept electrons and deposit as liquid iron metal, while the anode emits pure oxygen gas as oxide ions release electrons.

The beauty here is that this electrolysis reaction produces no carbon dioxide or other greenhouse gases, provided the electricity comes from clean sources. MOE’s fundamental chemistry is strikingly elegant, a pure expression of electrochemical principles: electrons doing directly what carbon traditionally accomplishes indirectly.

But while electrochemistry textbooks celebrate simplicity, industrial implementation wrestles with realities that are less forgiving. The extreme operating conditions present considerable hurdles. MOE cells operate at around 1600°C, temperatures that relentlessly challenge materials durability. The electrolyte, a molten oxide mixture acting as both reaction medium and solvent for iron oxide feedstocks, is corrosive and highly reactive.

Electrodes, in particular, face continuous assault. The inert anode, essential for preventing carbon emissions, must not only survive prolonged exposure to hot oxygen gas but also maintain its integrity without dissolving or flaking away. MIT’s critical discovery in the early 2010s identified iron-chromium alloys capable of forming protective oxide layers under these harsh conditions. While promising, even these alloys aren’t foolproof. Protective layers can spall or degrade under continuous high-temperature oxidative stress. This underscores the ongoing challenge of balancing electrochemical stability, electrical conductivity, and economic affordability in anode material selection.

From an operational standpoint, another subtle complexity is slag management. Iron ores inevitably contain silica, alumina and lime oxides (gangue) that don’t reduce electrolytically. Instead, these impurities accumulate as slag floating atop the heavier molten iron. Slag management involves maintaining optimal viscosity, melting temperature, and electrical conductivity, requiring precise chemical adjustments. Managing this molten slag layer adds another layer of operational complexity, requiring periodic removal to avoid deterioration of electrochemical performance.

Ideally, continuous slag tapping would ensure consistent operating conditions. Realistically, maintaining continuously open taps at 1600°C is difficult, prompting semi-batch or periodic tapping methods. This semi-batch approach appears suboptimal compared to a fully continuous system, but might be an important pragmatic compromise. However, this shouldn’t be an issue in steel production, and could arguably alleviate batch concerns.

At present, iron furnaces are tapped around every hour, a batch process. With major iron furnaces producing 20,000 tons of iron a day, 2,000 MOE cells would be required to deliver the same volumes. The cells could be operated to provide a fairly continuous stream of tapped steel, which might or might not have value to operations. They can also be configured to provide numerous batch increments if that’s of value. That flexibility should mean that integrating them into operations is relatively straightforward, as is innovation in operations.

MOE also brings distinctive electrical characteristics. Cells typically operate at very high currents, hundreds of thousands of amperes, but at extremely low voltages, typically only a few volts. To visualize this clearly, imagine the difference between a garden hose and a broad, slow-moving river. High electrical currents equate to large amounts of water. High voltages equate to high velocities. A hose has small amounts of water moving quickly, like the electricity in a house.

A river has a lot of water moving slowly, like the electricity in an MOE cell. This unusual electrical balance necessitates specialized infrastructure. Enormous currents demand robust, thick busbars, heavy-duty transformers, and advanced rectifiers. High currents induce strong electromagnetic fields, further complicating reactor design. Safely and efficiently managing this electrical environment is crucial to the technology’s economic feasibility.

The economic dimension presents a fascinating tradeoff. Because MOE requires no coke ovens, blast furnaces, or extensive raw materials handling, plant configurations are much simpler, potentially driving down capital expenditure compared to traditional integrated steelworks. The cell-based approaches, with the target size being school-bus sized units capable of producing 10 tons of steel per day, provide a modular and manufacturable base component, which should be valuable for cost and quality control.

However, the electrochemical cell equipment itself, including the inert electrodes, specialized refractories, and high-current electrical infrastructure, still requires substantial upfront investment. Boston Metal, the leading commercial player in MOE, likens plant economics to aluminum smelters, known for large capital expenditures. Early estimates suggest around $1,000 per annual ton capacity, a substantial, though not extraordinary, figure within heavy industry.

While initial capital intensity is meaningful, operating expenditure is notably dominated by electricity costs. With approximately 4 megawatt-hours of electricity required per ton of steel, MOE’s economic viability hinges critically upon electricity pricing. At $20 per MWh, production costs are attractive, around $80 per ton in electrical energy alone. At $50 per MWh, that jumps to $200 per ton—manageable but challenging without carbon pricing incentives. At $100 per MWh, the cost rapidly becomes prohibitive, around $400 per ton just in energy, exceeding the current all-in production costs of conventional steel. These calculations highlight the vital role of low-cost renewable electricity in making MOE economically sustainable.

Operational resilience is another important consideration. MOE cells do not react kindly to unexpected power interruptions. A sudden loss of electrical current quickly leads to cooling and solidification of the molten bath, an undesirable scenario known as a “cell freeze.” Restarting from such a freeze can cause severe reactor damage and lengthy downtimes. Consequently, MOE plant designs will have to incorporate robust backup power supplies, preventive maintenance cycles, and carefully managed controlled shutdown procedures. The ongoing operational balance is delicate: continuous uptime is ideal, but thermal and mechanical realities mandate cautious management of interruptions and transitions.

Nonetheless, opportunities presented by MOE remain compelling. The pure product — carbon-free molten iron — is a valuable blank canvas. Downstream metallurgy can precisely control carbon addition, tailoring steel properties exactly to market demands. Unlike blast furnace iron, which emerges with uncontrolled carbon, silicon, and sulfur contents requiring further refining, MOE iron is virtually free of contaminants, simplifying secondary metallurgy. Moreover, the process can theoretically use a wider range of iron ore grades, sidestepping the premium costs associated with high-quality pellets or concentrates needed in traditional ironmaking.

This range of inputs makes MOE compelling, as other DRI solutions, while having much more standard chemistries and mature components, need higher-grade ores. This, along with the electricity-only energy supply and modularity, suggests to me that MOE has a strong upside as part of the technology mix.

Looking globally, the developmental landscape for MOE currently features Boston Metal at the forefront. MIT’s initial research laid the foundation, and Boston Metal’s steady progress toward commercialization suggests pilot demonstration by the late 2020s. European efforts, while historically influential in early-stage research, now closely follow Boston Metal’s milestones, often participating through investment rather than parallel development. China, notably, has remained focused elsewhere, prioritizing hydrogen-based and efficiency-driven steel decarbonization, possibly awaiting MOE’s demonstration results before engaging fully.

In the context of my recent downward-adjusted steel demand projections, driven by declining cement and construction trends, MOE’s role must be assessed realistically. Lower global steel requirements sharpen the competition among emerging technologies. High capital expenditure technologies like MOE require careful market placement, likely limited initially to regions with ample renewable electricity and supportive carbon pricing regimes. Its economic sensitivity to electricity prices places clear boundaries on practical deployment scenarios. Yet, MOE’s genuine potential to produce truly zero-emission iron remains undeniable.

Molten oxide electrolysis embodies a fascinating intersection of elegant electrochemical theory and challenging industrial practice. Its inherent simplicity in concept belies the considerable engineering complexity in implementation. While its capital and operational expenditures present distinct tradeoffs shaped heavily by electricity economics, its potential as a genuinely zero-carbon steel production method remains profoundly appealing. As steel demand projections shift downward, the need for careful strategic selection among available decarbonization options intensifies.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy