Last Updated on: 12th July 2025, 10:36 am

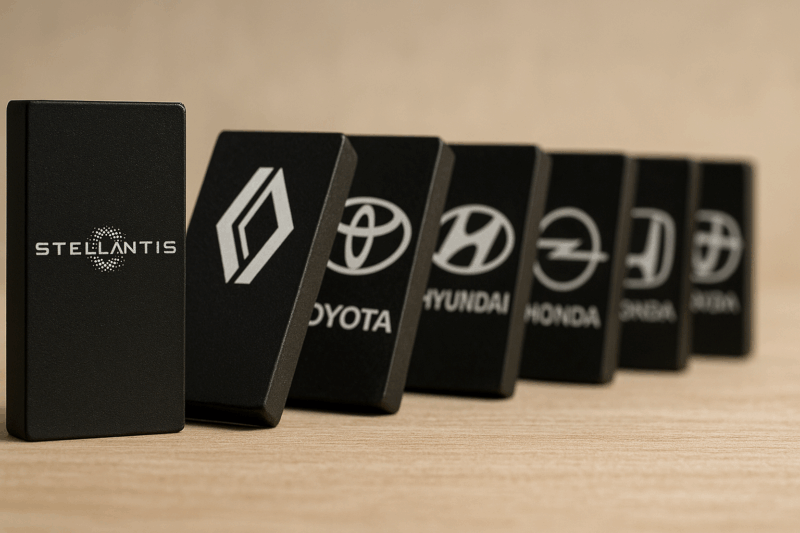

Stellantis, one of the world’s five largest automakers and a proponent of hydrogen fuel cell electric vehicles for light commercial vehicles, has now formally signaled a retreat from its hydrogen ambitions. This pivot away from hydrogen-powered transportation represents yet another confirmation of the longstanding challenges faced by hydrogen in mobility markets. Stellantis’ shift underscores fundamental economic and infrastructural weaknesses that have inevitably plagued hydrogen-based vehicle strategies, despite persistent over optimism and far too much investment.

This recent announcement follows Stellantis’ high-profile commitment in early 2024 when it launched eight new hydrogen fuel cell electric van models. At the time, Stellantis aimed to position itself prominently as Europe’s leader in zero-emission commercial vehicle propulsion, taking a 33% stake in French fuel cell supplier Symbio. The automaker projected production of up to 10,000 hydrogen-powered vans by the end of 2024, suggesting confidence in a market poised to expand rapidly due to expected policy support and infrastructural investments across Europe.

However, within months, reality began to intrude sharply on these optimistic projections. Former Stellantis CEO Carlos Tavares publicly acknowledged the prohibitively high costs associated with hydrogen mobility. In April 2024, just two months after the ambitious launch, Tavares admitted that hydrogen fuel cell vehicle costs were extremely high and far from affordable. Despite efforts to make these vehicles competitive, including slashing the price of its Opel Vivaro HYDROGEN van by 40%, the vehicle remained roughly 80% more expensive than comparable battery-electric alternatives. The harsh economic reality became impossible for Stellantis to ignore or mitigate, raising fundamental questions about hydrogen’s viability for commercial transportation at scale.

The departure of Tavares in late 2024 further highlighted strategic uncertainties within Stellantis. While his departure was attributed broadly to disagreements with the board, the unresolved questions about the direction of Stellantis’ hydrogen strategy likely played a part in the decision-making turbulence at the automaker. Stellantis’ subsequent decision to step back from hydrogen confirms the deep-rooted structural issues that hydrogen transportation has consistently encountered, particularly the failure of anticipated European policy and infrastructure investments to materialize.

The promised hydrogen refueling infrastructure, a critical prerequisite for meaningful adoption of hydrogen vehicles, has seen little progress in Europe. Member states have not delivered on implementing the EU’s Alternative Fuels Infrastructure Regulation, likely because countries that aren’t Germany see it as nonsensical and expensive, leaving Stellantis and other automakers who invested heavily in hydrogen vehicles without refueling infrastructure to support even modest fleet expansion. This mirrors the pattern seen elsewhere, where hydrogen infrastructure promises have repeatedly been announced but rarely delivered at meaningful scale, and where early rollouts have seen abandonments of refueling such as Shell’s global retreat.

Renault’s recent failure with its Hyvia joint venture illustrates a similar narrative. Hyvia, Renault’s partnership with Plug Power aiming to produce and supply hydrogen fuel-cell vans and related infrastructure, was liquidated by a French court earlier this year after failing to secure enough orders to remain viable. Renault CEO Luca de Meo bluntly acknowledged the lack of a market for hydrogen vehicles, confirming the severe mismatch between optimistic industry forecasts and actual consumer demand. The collapse of Hyvia, which once was heralded as a strategic pathway for Renault into hydrogen, further exemplifies how even well-backed partnerships falter when confronting hydrogen mobility’s inherent limitations.

The fate of Symbio, France’s leading fuel-cell supplier, also hangs in the balance following Stellantis’ strategic withdrawal. Symbio recently appointed Jean-Baptiste Lucas, former CEO of insolvent electrolyzer manufacturer McPhy, as its new leader, which itself signals uncertainty around the company’s future prospects. Stellantis’ withdrawal creates significant uncertainty for Symbio, given Stellantis was a major investor and customer. Without firm commitments from automakers, fuel-cell suppliers face a difficult road ahead, vulnerable to market contractions that have already undermined other hydrogen-focused ventures globally.

In Paris, the experience of Hype taxi offers another pointed example of hydrogen transportation’s challenges. Initially celebrated as a bold venture to deploy hydrogen-powered taxis across France’s capital, Hype ultimately abandoned its hydrogen ambitions and pivoted decisively toward battery-electric vehicles. Despite substantial initial investments and high-profile partnerships intended to expand hydrogen refueling networks, the economic realities forced Hype’s leadership to acknowledge that hydrogen taxis were simply too costly and infrastructure-dependent to sustain.

Similar scenarios have unfolded repeatedly around the world. Nikola Corporation in the United States initially promised a bold vision for hydrogen-powered trucks, often more a fraudulent mirage than a reality. The fraudulent mirage caught up with it and its founder and CEO, with over $100 million fines and a four year jail sentence, one prevented only by a full pardon by another CEO with a history of fraudulent business dealings under his belt, not that that prevented American’s for voting him in as President. Regardless, Nikola went bankrupt as was almost certain from the beginning.

Similarly, Hyundai scaled back production targets for its NEXO hydrogen vehicle due to weak sales and insufficient infrastructure. It’s bringing a redesigned NEXO to market for the 2026 model year, at least in theory, but as the global hydrogen car market is plumbing new depths of homeopathy, it’s questionable whether that it will ever hit showrooms, never mind streets.

Toyota’s Mirai, heavily subsidized and promoted as the flagship hydrogen passenger vehicle, has failed to gain significant traction even in supportive markets. In California, people who bought into the hydrogen dream via leasing a Mirai are protesting in the streets and suing Toyota.

Universal Hydrogen and ZeroAvia, two high-profile hydrogen aviation ventures, have faced continuous delays and financial pressures. Universal rolled up shop last year, while ZeroAvia continues to roll slowly along and occasionally off of the runway.

Among the persistent financial challenges facing the hydrogen sector, Plug Power, Ballard Power and FuelCell Energy stand out as emblematic cautionary tales. Plug Power has lost $3.12 billion since 2010, an average of roughly $200 million a year, without ever reporting a profit. Its 2023 losses alone totaled nearly $1.4 billion, with comparable losses expected in 2024. Most recently, it’s stock price dipped into delisting territory, below $1 per share, for 27 trading days, almost hitting the 30 day marker that automatically triggers delisting. (Mea culpa: in a previous article I thought it had had hit 30 days, but it inched up above the threshold before the 30 days were up.)

Ballard Power, founded in 1979 and pivoted to fuel cells in the late 1980s, has similarly never reported an annual profit, losing an average of $55 million a year since 2000, amounting to more than $1.3 billion in cumulative losses, while its stock price languishes near penny levels.

FuelCell Energy, public since 1992, has amassed losses of $680 million between 2019 and 2024, averaging about $113 million per year, also never turning a profit in its more than five decades of operation. These three firms show how even decades of effort, hundreds of millions in subsidies and repeated technological pivots cannot overcome the structural weakness of hydrogen markets.

Most recently PlugPower announced a stunning 200 to one reverse stock split. That’s among the largest single point in time reverse stock splits, although not the largest overall. FuelCell Energy has been desperately trying to keep its stock above $1. Most recently it reverse split 30 to one in late 2024, but its history of occasional splits and frequent reverse splits nets out to a 720 to one reverse split.

That said, Plug Power’s fiscal position is about what you would expect from a company that has bled money for decades. While the Board approved the stratospheric reverse split, it didn’t approve issuing more shares for sale to try to raise money. The firm only has the loan from the US DOE for hydrogen electrolysis facilities that are facing serious headwinds under the Trump Administration. While the loans were guaranteed under the Biden Administration and appear not to have been yanked, that doesn’t mean the hydrogen facilities will be built, that the loan funds will be disbursed or that Plug Power will be able to pay them back. My bet is mostly no to all three.

Stellantis’ decision aligns perfectly with these patterns previously detailed in analyses of hydrogen transportation failures, including my January 2025 assessment in Transportation Firm Deathwatch. There, I highlighted that hydrogen-powered electric vertical takeoff and landing (eVTOL) aircraft projects faced identical structural hurdles as ground-based hydrogen vehicles: uncompetitive economics, daunting infrastructural requirements, and overly complex supply chains. Stellantis’ exit confirms that these structural limitations are neither isolated nor sector-specific, but endemic to hydrogen as a transportation fuel.

Ultimately, Stellantis’ departure from hydrogen is not simply a company-specific retreat. Instead, it should be viewed as confirmation of a broader strategic shift within the transportation industry. I’ve been tracking the collapse of the illusion that hydrogen will be a transportation fuel, something that’s been obviously coming for a long time, but which was clearly going to happen in large part this year as funding ran out and it was impossible for founders to cover up the failures with a song and dance anymore. Of the 162 firms in my tracking spreadsheet, a full 34 have now gone belly up or dropped hydrogen, and firms like Plug Power and Fuel Cell Energy are hanging on by their fingernails.

The persistent failure of hydrogen mobility initiatives worldwide underscores hydrogen’s fundamental disadvantages compared to battery-electric alternatives, which offer lower costs, simpler infrastructure needs, and proven scalability. Policymakers, investors, and automakers should now carefully reassess any lingering hydrogen mobility ambitions against the comprehensive record of consistent, costly failures exemplified by Stellantis’ experience.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy