Support CleanTechnica’s work through a Substack subscription or on Stripe.

The just-commissioned Calistoga hydrogen microgrid is a telling example of how public money can end up funding energy pathways that deliver little of what they promise. At first glance, the project appears well-intentioned. PG&E has positioned it as a resilience measure for a California community that faces wildfire-driven grid shutoffs. The idea is to provide local power through a hydrogen fuel cell system during outages, avoiding diesel generators and the associated emissions. It is an easy story to sell to regulators, politicians, and residents.

The problem is that the actual performance, in terms of both emissions and efficiency, looks nothing like the clean, forward-looking image in the press releases.

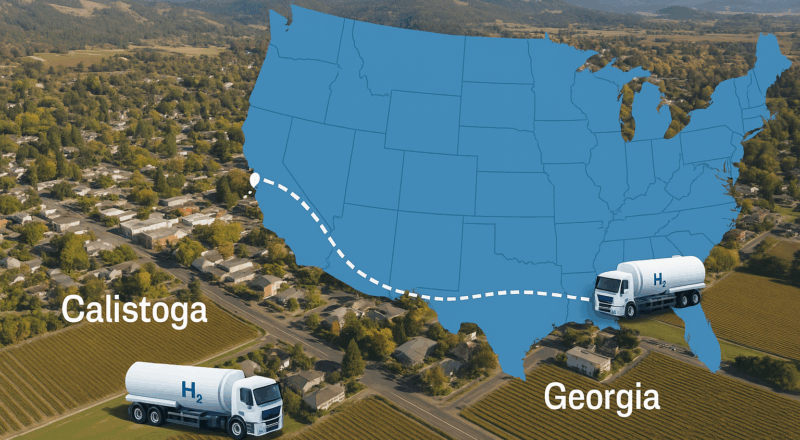

The hydrogen for this microgrid is not produced locally from clean electricity. It comes from Plug Power’s grid-connected electrolyzer in Georgia, more than 2,800 miles away. The plant runs on the Georgia grid, which in 2023 had an average carbon intensity of about 0.33 kg of CO2 per kWh. Electrolysis requires roughly 57.5 kWh to produce one kilogram of hydrogen. Liquefying that hydrogen so it can be shipped cross-country adds about 12 kWh per kilogram. That means the total electricity consumed at the source is close to 69.5 kWh for every kilogram of hydrogen produced and liquefied. Multiplying that by Georgia’s carbon intensity yields roughly 23 kg of CO2 emissions per kilogram of hydrogen before it even leaves the state.

Trucking liquid hydrogen across the country adds a little more. Modern cryogenic trailers can carry just over 4 tons of hydrogen. Over 2,800 miles, that equates to about 0.5 kg of CO2 for each kilogram of hydrogen delivered. That number barely moves the needle compared to the production and liquefaction emissions, but it still pushes the total to around 23.6 kg of CO2 per kilogram delivered in California.

Of course, hydrogen boils off, and US cryogenic hydrogen trucks don’t typically capture boiled off hydrogen, although the Calistoga facility apparently does capture and use it, so add another kilogram or more of CO2e to every kilogram of delivered hydrogen.

Once there, the hydrogen is converted back to electricity in a stationary PEM fuel cell. Even at the upper end of efficiency for systems of this size, around 50%, each kilogram of hydrogen produces only about 16.6 kWh of electricity. Dividing total emissions by the energy output means the electricity delivered in Calistoga has a carbon intensity in the range of 1,400 to 1,600 grams of CO2 per kWh. That is several times higher than the California grid average and worse than a modern diesel generator.

One of the involved firms — and more on the two usual suspects later — claim the hydrogen meets the federal standard of four kilograms of carbon dioxide emitted per kilogram of hydrogen, but it’s deeply unclear how.

This raises questions about why public funds were directed to such a solution in the first place. State and federal programs, as well as utility ratepayer funds, are being used to finance systems that deliver higher carbon intensity than the grid they are supposed to replace. Part of the answer lies in the policy preference for visible, tangible infrastructure that can be ribbon-cut and photographed, rather than lower-cost, higher-performance solutions that are less photogenic. A big part lies in California being an epicenter of hydrogen folly, with numerous lobbying offices in Sacramento continuing to wield their influence to keep the public purse open. Another part lies in the entrenched presence of companies like Plug Power, which has spent decades building relationships with policymakers despite never achieving profitability and consistently underperforming financially. Projects like Calistoga provide revenue and market presence for such firms while offering zero benefit in terms of decarbonization.

It’s certainly not as if Calistoga, population 5,022, could afford the $46.3 million that California’s Public Utility Commission approved PG&E to throw away on this capital and operationally expensive approach to keeping the lights on. Their budget is only about $14 million a year. It’s also not as if a small rural town didn’t have room to put a big array of solar and batteries, but Energy Vault claims that only a smaller lot was available to lease from the city, so they couldn’t do anything sensible.

It is also not surprising that companies from other contested corners of the energy sector are now moving into hydrogen. Energy Vault began with a gravity storage concept that involved stacking and lowering massive concrete blocks. From the start, its physics and economics compared poorly to pumped hydro or batteries, and real-world deployments have been limited with only one in operation and no public information on price or independent performance assessments.

The challenge for a publicly traded company with a technology that has failed to meet market needs is how to create a new growth narrative that can attract investor and government attention. Hydrogen, with its steady flow of public funding announcements and its portrayal as a clean fuel of the future, is an obvious candidate. Energy Vault’s move toward integrating hydrogen storage into its portfolio looks almost inevitable, regardless of whether the technology will work better than its original concept. Certainly it moved into lithium battery energy storage systems quickly after its SPAC, leveraging it to become a significantly overcapitalized battery storage developer.

The physics of hydrogen storage for grid applications are not forgiving. Round-trip efficiency is far lower than batteries or pumped hydro. Compression or liquefaction adds significant energy costs, and the infrastructure is expensive to build and maintain.

The common thread between the Calistoga microgrid and Energy Vault’s hydrogen ambitions is not technical merit but the alignment of corporate survival needs with public funding priorities. Firms with underperforming business models have strong incentives to position themselves as players in sectors where policy is creating demand regardless of economics. For policymakers, the combination of job creation claims, local infrastructure spending, and a green narrative can be persuasive. Without careful scrutiny of actual performance, the result is projects that consume scarce funds and deliver little in terms of emissions reductions or resilience.

California’s wildfire-driven grid challenges are real, but there are proven alternatives that could meet them more effectively. Solar arrays paired with batteries can operate independently of the grid for days, and can be sized to the needs of communities like Calistoga. Thermal storage or biofuel capable generators using sustainably sourced fuels could provide resilience with far lower lifecycle emissions. These solutions lack the novelty factor of hydrogen or the architectural spectacle of a gravity storage tower, but they work, and they deliver measurable results.

And as noted, the current hydrogen solution is higher emissions than just running diesel generators.

The lesson from Calistoga is that good intentions and public investment do not automatically produce good outcomes. Without aligning technology choices with real-world performance and lifecycle emissions, communities risk locking themselves into high-cost, high-carbon pathways under the banner of clean energy. The attraction of hydrogen as a narrative will keep drawing in companies that need a new story to tell investors, but attraction is not the same as suitability.

Policymakers and regulators need to look beyond the optics and assess whether the projects they fund are genuinely moving the energy system toward lower emissions and higher resilience, or whether they are simply sustaining the latest chapter of a long-running technology dead end.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy