Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Green hydrogen stakeholders in the US have been eagerly awaiting clarification on a potentially lucrative federal tax credit and they finally got what they wished for last Friday, when the Treasury Department issued its Final Rule. Normally that would spark a conversation about being careful what you wish for, but in this case it looks like a win-win for the emerging domestic green hydrogen industry.

Clean Hydrogen And Green Hydrogen

Green hydrogen is just one type of hydrogen covered by the new federal tax credit, which is described in section 45V of the 2022 Inflation Reduction Act. Conventional hydrogen extracted from natural gas is also potentially eligible for the credit. However, because the IRA is a climate bill in disguise, natural gas only qualifies if carbon capture is involved.

“To qualify as clean hydrogen under the statute, the lifecycle GHG emissions of the hydrogen production process must be no greater than 4 kilograms of carbon dioxide equivalents (CO2e) per kilogram of hydrogen produced,” the Treasury Department reminds everyone.

Overall, the IRA tax credit aims to move beyond natural gas, which currently accounts for about 95% of domestically produced hydrogen, and motivate investment in alternative hydrogen sources including biogas, biomass, and various types of solid waste or fugitive emissions. That’s in addition to green hydrogen, where much of the investor attention is focused today. Green hydrogen refers to electrolysis systems that push hydrogen gas from water, ideally powered by electricity from renewable resources (see more lots more green H2 background here).

Green Hydrogen And The Induced Emissions Question

All else being equal, green hydrogen produced from water can meet the 45V clean bar. However, the degree of cleanliness — and therefore the amount of the tax credit — is a lifecycle issue that depends on the source of the electricity.

The lifecycle calculation is fairly straightforward for a green hydrogen facility powered by dedicated renewable energy resources. Grid-connected facilities are a different matter. They can run 24/7 but the grid mix can vary considerably throughout the day depending on the price and availability of renewable energy, fossil energy, and/or nuclear energy.

If the 45V tax credit is applied willy-nilly to electrolysis facilities, it could end up incentivizing the construction of more fossil-fueled power plants, which is contrary to the purpose of a climate bill in disguise. That can be prevented by requiring electrolysis facilities to account precisely for their electricity sources, in order to qualify for the most lucrative tax credit.

“Specifically, the final rules require that taxpayers seeking to use Energy Attribute Certificates (EACs) to attribute electricity use to a specific generator meet certain criteria for temporal matching, deliverability, and incrementality,” the Treasury Department notes.

“As the final regulations explain, without those safeguards, that additional load on the grid from hydrogen production will result in induced emissions,” they emphasize.

Green Hydrogen And Energy Security

Green hydrogen producers were originally required to meet the accounting standard by 2028 in order to qualify for the top tax break. Among other benefits, the new rule gives them an extra two years, until 2030.

Relaxing the original deadline doesn’t look particularly good on paper. However, a number of environmental organizations have already given the Treasury Department a thumbs-up for supporting rapid growth in the green hydrogen industry over the short term, as a matter of long term gain.

“The final guidance is an important step towards a truly clean hydrogen industry. The rule provides much needed certainty for the industry and positions U.S. producers to be competitive in the global market,” observed NRDC, for example.

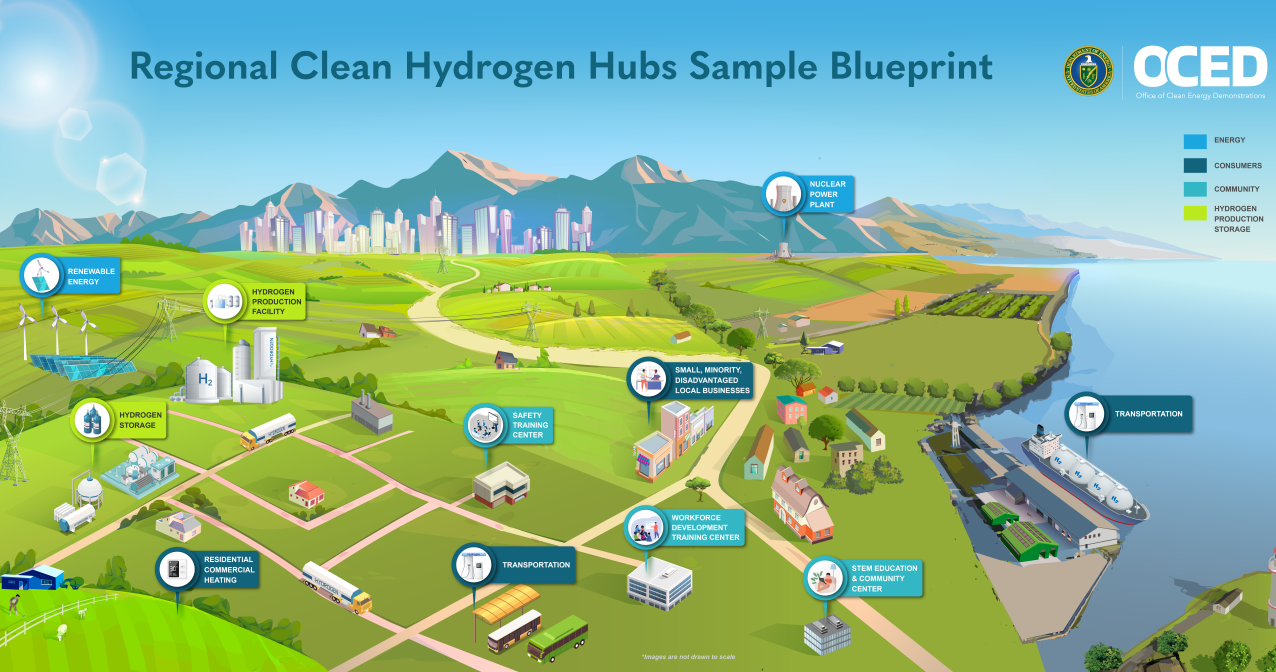

That point about global competition echoes the sentiments of the Treasury Department, which raised a related factor right at the top of its Final Rule announcement. “With the inclusion of these changes, the final rules provide clarity, investment certainty, and flexibility, including for participants in projects planned as part of the Department of Energy’s Regional Clean Hydrogen Hubs program,” the Treasury Department stated.

“Regional” is the operative word here. CleanTechnica has spilled plenty of ink on the Hydrogen Hubs program, which is funded to the tune of $7 billion by the 2021 Bipartisan Infrastructure Law and administered by the US Department of Energy. The law stipulates a carve-out for natural gas with carbon capture, but aside from that, the primary aim is to diversify the domestic hydrogen supply chain into more sustainable systems, with water electrolysis front and center (see more Hydrogen Hubs background here).

Aside from addressing climate concerns, the Hydrogen Hubs program has the over-arching goal of strengthening US energy and industrial security. A diverse hydrogen supply chain is a more resilient one, and diversity is particularly suited to a large nation like the US, where different regions can take best advantage of local resources and infrastructure.

What About Natural Gas With Carbon Capture?

As for global competition, natural gas stakeholders are left holding the bag. The American Petroleum Institute responded to the Final Rule with a statement indicating relief that the Treasury Department did not entirely pull the rug out from under natural gas. However, the carbon capture stipulation remains.

“This framework offers an opportunity for natural gas, when paired with carbon capture and storage, to compete more fairly in new markets and meet growing demand for affordable, reliable, lower-carbon energy,” API stated.

That remains to be seen. The US is not the only nation in search of alternative, more sustainable hydrogen supply chains. Despite the stubbornly high cost of green hydrogen, hub-style hydrogen initiatives and “hydrogen valleys” are appearing in other parts of the world. That includes Eastern Europe nations like Estonia and Ukraine, which are particularly interested in untangling themselves from the Russian energy web.

Closer to home, Canada is also gearing up to export a massive amount of green hydrogen and its sister product, green ammonia, to Belgium and elsewhere in Europe. If the US drops the ball on green hydrogen, plenty of others are ready to take its place.

The Writing Is Already On The Wall

That does not leave much room for natural gas, especially not with the added cost of carbon capture, and the Energy Department has already indicated as much. Of the seven Regional Clean Hydrogen Hubs designated for startup funding, six rely either fully or partially on water electrolysis and other sustainable systems.

The only outlier is ARCH2, the Appalachian Regional Hydrogen Hub. ARCH2 received Energy Department approval in 2023 for a model based on exclusively on natural gas, as enabled by the BIL. That’s far from a free ticket to ride. ARCH2 still needs to account for carbon capture in order to qualify for the IRA tax credit, and investors appear to be having second thoughts.

The Ohio River Valley Institute has been keeping tabs on ARCH2 and the picture is not pretty for carbon capture. In October of 2024 ORVI reported that four of the original development partners have withdrawn. ORVI describes two others as “in states of chronic financial crisis.” Another two reportedly lack any management experience relevant to the project.

Green Hydrogen Vs. Carbon Capture

To be clear, there is nothing wrong with carbon capture and sequestration in various forms. After all, plants and soils do it all the time. Human-made materials like concrete can also be enlisted to absorb excess carbon.

As applied to energy systems, though, the economic case for carbon capture has yet to emerge, at least not here in the US. In terms of coal power plants, the ill-fated FutureGen project of the early 2000’s was a warning sign, followed more recently by the collapse of carbon capture plans for the San Juan power plant.

It remains to be seen if green hydrogen stakeholders can take advantage of the new Final Rule over the next four years, which for better or worse will overlap almost entirely with a second term in office for President-elect Trump. If you have any thoughts about that, drop a note in the comment thread.

Follow me via LinkTree, or @tinamcasey on LinkedIn and Bluesky.

Image: The US Department of the Treasury had green hydrogen and energy security on its mind when it announced the Final Rule for H2 production tax credits (courtesy of US Department of Energy).

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy