Last Updated on: 8th July 2025, 11:45 am

Oh the irony, it burns. The US coal mining industry has blistered its way through the iconic coal producing Appalachian state of West Virginia for generations, permanently blowing up hundreds of pristine mountains along the way, and yet US President Trump keeps whining — loudly — about wind turbines spoiling the view. Even so, plans for a new 335-megawatt wind farm in West Virginia are moving forward.

Wind Farms Or Mountaintop Mining: Who Wore It Best?

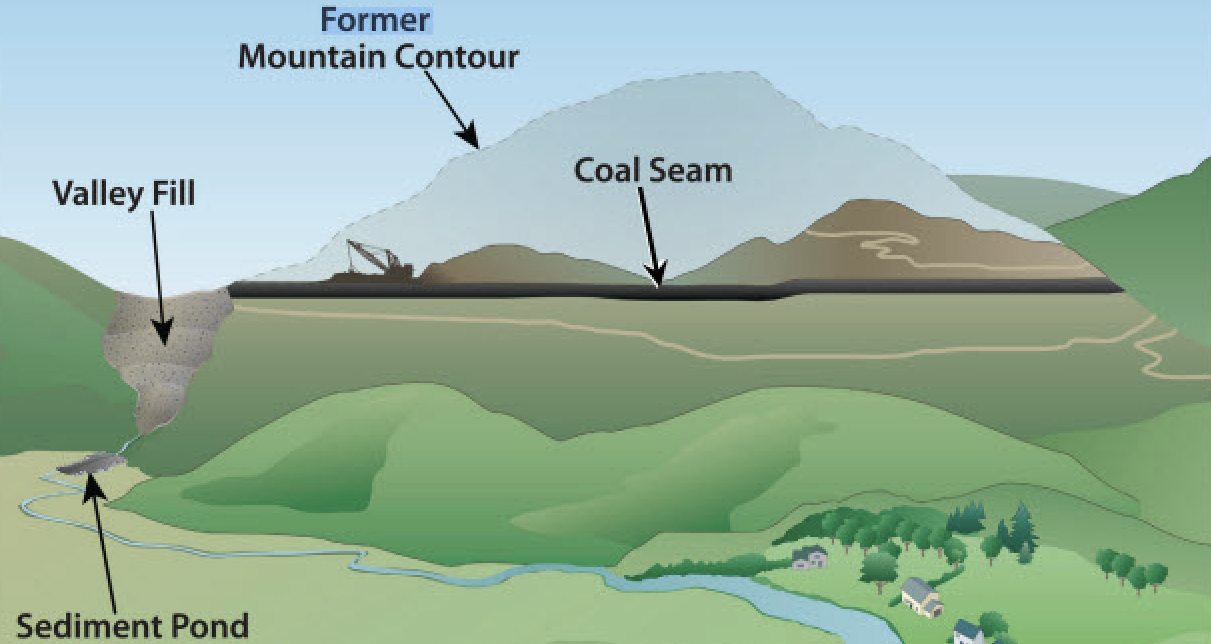

For those of you unfamiliar with the practice of mountaintop removal coal mining, that’s coalspeak for literally blowing up pristine mountains to reach sub-surface coal seams, destroying streams and valleys with rubble along the way. It’s a relatively recent development in US mining history, enabled by the relaxation of federal water quality protections during the Bush administration between 2002 and 2008 (see more mountaintop removal background here).

In contrast to the relatively small footprint of wind turbines, mountaintop removal wreaks widespread severe and irreversible damage upon the “Nation’s natural landscape,” as Trump would put it. One would think, going by the President’s frequent complaints about wind turbines and natural beauty, that ending mountaintop removal would be top of mind. One would be mistaken.

Besides, if one is expecting any sort of consistency from Trump, one has not been paying attention. After all, he didn’t earn the nickname “TACO” for nothing. If there is any consistency to be found inside the head that sits behind the Resolute Desk, it’s a longtime visceral hatred of wind turbines and wind farms.

That brings us to July 7, when the President forcefully reiterated his intention to suffocate the domestic wind and solar industries, leveraging the terms of the new Republican-enabled tax bill.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the President declared on July 7.

“The proliferation of these projects displaces affordable, reliable, dispatchable domestic energy sources, compromises our electric grid, and denigrates the beauty of our Nation’s natural landscape,” he added.

Meanwhile, West Virginia’s Wind Farms Are Getting Makeovers

If the words “wind farm” and “West Virginia” don’t seem to match up, guess again. Despite the coal industry’s iron grip on the economy (and public health) of West Virginia, wind farms began to populate the state back in 2002, when NextEra Energy broke ground on a 66-megawatt wind farm called the Mountaineer Wind Energy Center in Preston and Tucker counties.

According to the clean power tracker Cleanview, as of July 2025, West Virginia currently hosts eight utility-scale wind farms for a total of 856 megawatts.

West Virginia’s history in the wind industry is long enough to support repowering projects, in which an older wind farm is made over with new, more efficient turbines. In some repowering projects, the primary goal is to reduce the number of turbines needed to achieve the same output. In others, the aim is to increase the output with same the number of turbines — or to increase the output while decreasing the number of turbines, as the case may be.

Last fall the leading US renewable energy developer Clearway Energy Group, for example, announced the installation of 23 new wind turbines at the megawatt Pinnacle Wind Farm in Mineral County. Pinnacle went online in 2012 with a capacity of 54 megawatts. The repowering project added another 16% in capacity while keeping the number of turbines steady at 23.

A 335-Megawatt Makeover For The Mount Storm Wind Farm

That’s just for starters. In April, Clearway announced a power purchase agreement with Microsoft, in support of its plans for repowering the Mount Storm wind farm in Grant County.

“The Mount Storm project will be built with American-made equipment,” Clearway noted, referring to the US branch of the global turbine manufacturer Vestas.

“The agreement reflects Clearway’s strategic investment in domestically manufactured equipment,” the company emphasized. “The nacelles, which house the gearbox, generator, and other major turbine machinery, are made at a Brighton, Colorado factory, which employs over 500 people.”

Mount Storm began life in 2006 with 132 turbines. The repowering project will bring that number down to just 78, deploying Vestas’s V117 turbines. The new turbines weigh in at 4.3 megawatts each, bringing the capacity of the wind farm to 335 megawatts — an increase of 85%.

For the record, the initial capacity of the wind farm was 264 megawatts, with the original 132 turbines supplied by Gamesa at two megawatts each.

Wind developers like repowering projects because the property is already zoned and permitted for wind farms, eliminating some of the obstacles that beset new-built projects. Of course, Trump could attempt to stop the project. After all, he single-handedly crushed the domestic offshore wind industry practically to death upon taking office, though some projects have managed to trickle through.

Regardless, Clearway has already assembled a 30-gigawatt pipeline under its belt, with solar arrays, wind farms, and battery storage projects spread across 28 states, and it has assembled a new war chest of $1 billion to carry forth its renewable energy mission. Clearway announced the haul on June 25, in the form of corporate credit facilities issued through the firm Natixis Corporate and Investment Banking.

“This upsized financing underscores Clearway’s outstanding track record of development execution and is underpinned by solid fundamentals that drive our business today,” emphasized Clearway treasurer and SVP of corporate finance Max Gardner.

Credit facilities enable a developer to finance multiple projects without having to reinvent the loan application wheel for each one. “The corporate credit facilities consist of a $400 million revolving credit facility, a $350 million letter of credit facility, and a $169 million term loan,” Clearway explains.

Along with Nataxis CIB, Clearway also lists Canadian Imperial Bank of Commerce, KeyBank, MUFG Bank, National Australia Bank, Royal Bank of Canada, and Societe Generale as Joint Lead Arrangers.

Banco Bilbao Vizcaya Argentaria, Cooperatieve Rabobank, DNB Capital LLC, Desjardins Group, and Truist Bank also chipped in as Mandated Lead Arrangers, with Banco Santander and The Toronto-Dominion Bank filling the role of participating lenders.

“Natixis CIB also provided an additional $100 million letter of credit facility,” Clearway notes.

For the record, Clearway has more than 400 wind, solar, and storage projects in operation under its belt, large and small totaling 11.8 gigawatts across 35 states, having raised more than $20.5 billion to date.

What do you think, will passage of the new tax bill throw a monkey wrench into Clearway’s new $1 billion line of credit? Drop a note in the comment thread.

Image: US President Trump claims that wind farms spoil the view of “our Nation’s natural landscape. Clearly he has never visited a mountaintop removal coal mining operation (via US Environmental Protection Agency).

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy